Financial Review

Group Financial Results

Revenue

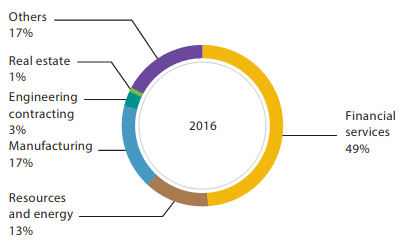

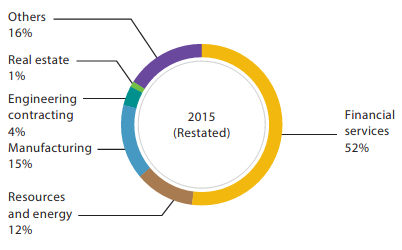

For 2016, CITIC Limited recorded revenue of HK$380,822 million from continuous operations, a decrease of HK$14,488 million or 4%, as compared with the same period last year. Excluding gains of HK$12.2 billion recognised for the same period last year as a result of the disposal of 3.16% equity interests in CITIC Securities and the dilution of CITIC Limited’s equity interests following the placing of new shares by CITIC Securities, as well as the impact of translation due to RMB depreciation for the current period, the increase amounted to HK$14 billion or 4%. Revenue from financial services was decreased by HK$17,841 million or 9% to HK$187,537 million. Excluding gains recognised for the same period last year as a result of the disposal of 3.16% equity interests in CITIC Securities and the dilution of CITIC Limited’s equity interests following the placing of new shares by CITIC Securities, as well as the impact of translation due to RMB depreciation for the current period, the increase amounted to HK$6.4 billion or 3%, mainly attributable to the revenue contribution from banking business. The gradual increase in the international demand for bulk commodities and energy drove the increase in revenue from iron ore and copper trade. The Sino Iron project were in full operation in the second half of the year, recording revenue of approximately HK$3.6 billion. Revenue contributions from the power generation and platinum operations decreased year-on-year due to factors including lower prices, partially offsetting the aforesaid growth. The manufacturing segment recorded revenue of HK$62,350 million, an increase of HK$2,273 million or 4%, due to the sales of aluminum wheels and castings grew, but the escalating competition in the heavy machinery industry and the decline in order prices partially offset the aforesaid growth, in addition, even though the prices of special steel products keeping declining, the sales volume grew, revenue from special steel business maintained stable. The engineering contracting business recorded revenue of HK$11,023 million, a year-on-year decrease of HK$3,653 million or 25%, as its new projects were at initial stage or in phase of contract negotiation. Revenue from continuous operations of the real estate segment amounted to HK$4,900 million. Revenue from other businesses amounted to HK$64,723 million, an increase of HK$1,375 million or 2%, mainly attributable to the increase in revenue from Dah Chong Hong’s acquisition of LF Asia’s food and healthcare business and the notable year-on-year increase in the business scale of CITIC Envirotech, but the decline in traditional telecommunications services and international automobile sales partially offset the growth impact.

| Year ended 31 December | Increase/(decrease) | |||

|---|---|---|---|---|

| Continuing operations HK$ million |

2016 | 2015 (restated) |

Amount | % |

| Financial services | 187,537 | 205,378 | (17,841) | (9%) |

| Resources and energy | 50,254 | 45,664 | 4,590 | 10% |

| Manufacturing | 62,350 | 60,077 | 2,273 | 4% |

| Engineering contracting | 11,023 | 14,676 | (3,653) | (25%) |

| Real estate | 4,900 | 6,025 | (1,125) | (19%) |

| Others | 64,723 | 63,348 | 1,375 | 2% |

By nature

| Year ended 31 December | Increase/(decrease) | |||

|---|---|---|---|---|

| Continuing operations HK$ million |

2016 | 2015 (restated) |

Amount | % |

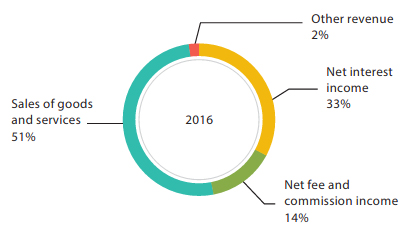

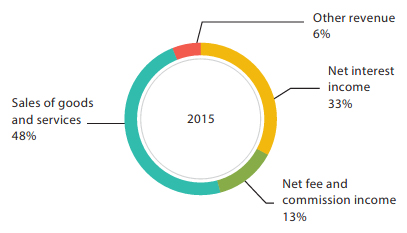

| Net interest income | 125,923 | 131,883 | (5,960) | (5%) |

| Net fee and commission income | 54,578 | 48,899 | 5,679 | 12% |

| Sales of goods and services | 193,292 | 189,880 | 3,412 | 2% |

| – Sales of goods | 156,528 | 149,628 | 6,900 | 5% |

| – Services rendered to customers | 26,895 | 27,370 | (475) | (2%) |

| – Revenue from construction contracts | 9,869 | 12,882 | (3,013) | (23%) |

| Other revenue | 7,029 | 24,648 | (17,619) | (71%) |

Impairment losses

In 2016, the Group recorded an asset impairment of HK$73,590 million, a year-on-year decrease of HK$5,598 million or 7%. Of the total impairment, CITIC Bank accounted for HK$61,171 million, which mainly includes HK$53,481 million impairment on its loans and advances to customers. The other major impairment loss of HK$10,152 million was related to the Sino Iron Project in Australia.

Net finance charges

In 2016, finance costs amounted to HK$8,688 million, a decrease of HK$551 million or 6% compared with the same period last year, mainly attributable to a year-on-year decrease in debt size both at operation management and subsidiaries in the non-financial segments.

In 2016, finance income from operation management and subsidiaries in the non-financial segments amounted to HK$1,552 million, a year-on-year decrease of HK$806 million or 34%. This increase mainly came from interest income on bank deposits.

Interest expense capitalised

In 2016, interest expense capitalised amounted to HK$576 million, a year-on-year decrease of HK$1,562 million or 73%. This was mainly because that the 6 production lines of Sino Iron were in full operation, interest expense capitalised decreased correspondingly.

Income tax

In 2016, income tax of the Group was HK$18,393 million, a decrease of HK$1,031 million compared with the same period last year. This was in line with the change in profit before taxation.