Group Financial Position

| In HK$ million | As at 31 December 2014 | As at 31 December 2013 (restated) | lncrease/(Decrease) | Note to the Consolidated Financial Statements | |

| Total assets | 5,947,831 | 5,321,709 | 626,122 | 12% | |

| Loans and advances to customers and other parties | 2,711,851 | 2,419,803 | 292,048 | 12% | 26 |

| Investments classified as receivables | 834,652 | 381,783 | 452,869 | 119% | 29 |

| Financial assets held under resale agreements | 172,100 | 365,361 | (193,261) | (53%) | 25 |

| Fixed assets | 179,303 | 174,534 | 4,769 | 3% | 33 |

| Inventories | 133,258 | 136,631 | (3,373) | (2%) | 24 |

| Total liabilities | 5,372,324 | 4,805,157 | 567,167 | 12% | |

| Deposits from customers | 3,586,508 | 3,345,943 | 240,565 | 7% | 41 |

| Deposits from banks and non-bank financial institutions | 871,213 | 709,621 | 161,592 | 23% | 37 |

| Bank and other loans | 218,993 | 217,518 | 1,475 | 1% | 42 |

| Debt instruments issued | 273,126 | 201,151 | 71,975 | 36% | 43 |

| Total ordinary shareholders'funds and perpetual capital securities | 431,960 | 385,614 | 46,346 | 12% | |

Total assets

Total assets increased from HK$5,321,709 million as at 31 December 2013 to HK$5,947,831 million as at 31 December 2014, mainly attributable to an increase in investments classified as receivables and loans and advances to customers and other parties by CITIC Bank.

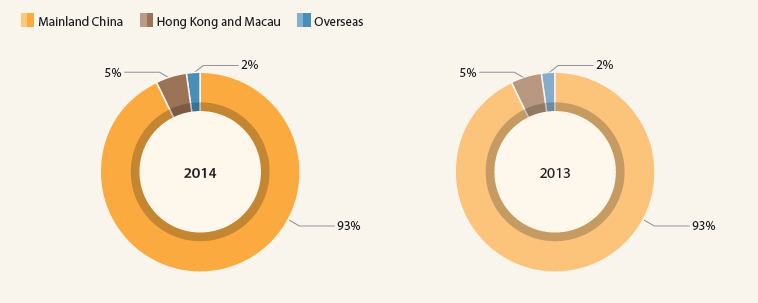

By geography

Loans and advances to customers and other parties

As at 31 December 2014, the loans and advances to customers and other parties of the Group was HK$2,711,851 million, an increase of HK$292,048 million, or 12% from 2013. The proportion of loans and advances to customers and other parties to total assets was 46%, an increase of 0.1% compared with 31 December 2013.

| In HK$ million | As at 31 December 2014 | As at 31 December 2013 (restated) | Increase/(Decrease) | |

| Corporate loans | 1,991,735 | 1,832,969 | 158,766 | 9% |

| Discounted bills | 86,254 | 82,383 | 3,871 | 5% |

| Personal loans | 702,963 | 560,358 | 142,605 | 25% |

| Total loans and advances to customers and other parties | 2,780,952 | 2,475,710 | 305,242 | 12% |

| Impairment allowances | (69,101) | (55,907) | 13,194 | 24% |

| Net loans and advances to customers and other parties | 2,711,851 | 2,419,803 | 292,048 | 12% |

Deposits from customers

As at 31 December 2014, deposits from customers of the financial institutions under the Group were HK$3,586,508 million, an increase of HK$240,565 million, or 7% compared with 31 December 2013. The proportion of deposits from customers to total liabilities was 67%, a decrease of 3% compared with 31 December 2013.

| In HK$ million | As at 31 December 2014 | As at 31 December 2013 (restated) | Increase/(Decrease) | |

| Corporate deposits | ||||

| Time deposits | 1,729,747 | 1,514,704 | 215,043 | 14% |

| Demand deposits | 1,205,007 | 1,176,519 | 28,488 | 2% |

| Subtotal | 2,934,754 | 2,691,223 | 243,531 | 9% |

| Personal deposits | ||||

| Time deposits | 464,578 | 492,637 | (28,059) | (6%) |

| Demand deposits | 187,176 | 162,083 | 25,093 | 15% |

| Subtotal | 651,754 | 654,720 | (2,966) | (0%) |

| Total | 3,586,508 | 3,345,943 | 240,565 | 7% |

Bank and other loans

| In HK$ million | As at 31 December 2014 | As at 31 December 2013 (restated) | lncrease/(Decrease) | ||

| Financial services | - | - | - | - | |

| Resources and energy | 42,798 | 48,128 | (5,330) | (11%) | |

| Manufacturing | 19,130 | 21,297 | (2,167) | (10%) | |

| Engineering contracting | 2,142 | 2,479 | (337) | (14%) | |

| Real estate and infrastructure | 85,765 | 93,793 | (8,028) | (9%) | |

| Others | 22,603 | 17,793 | 4,810 | 27% | |

| Operation management | 85,754 | 69,304 | 16,450 | 24% | |

| Elimination | (39,199) | (35,276) | 3,923 | 11% | |

| Total | 218,993 | 217,518 | 1,475 | 1% | |

Debt instruments issued

| In HK$ million | As at 31 December 2014 | As at 31 December 2013 (restated) | lncrease/(Decrease) | |

| Financial services | 169,215 | 97,773 | 71,442 | 73% |

| Resources and energy | - | 6,187 | (6,187) | (100%) |

| Manufacturing | 5,054 | 4,220 | 834 | 20% |

| Engineering contracting | - | - | - | - |

| Real estate and infrastructure | - | - | - | - |

| Others | 3,477 | 3,757 | (280) | (7%) |

| Operation management | 95,660 | 90,093 | 5,567 | 6% |

| Elimination | (280) | (879) | (599) | (68%) |

| Total | 273,126 | 201,151 | 71,975 | 36% |

Total ordinary shareholders’ funds and perpetual capital securities

Total ordinary shareholders’ funds and perpetual capital securities increased from HK$385,614 million as at 31 December 2013 to HK$431,960 million as at 31 December 2014, mainly attributable to an increase in profit as well as other comprehensive income for the year.