Financial Services

CITIC Bank

CITIC Bank is a fast-growing commercial bank engaged in the corporate banking, retail banking and financial markets businesses.

Year in review

Ongoing reform of the financial system and interest rate liberalisation continued to drag down the performance of the Chinese banking sector in 2016, compounded by volatility in global markets and rising competition from fast-growing fintech players. These headwinds presented an increasingly challenging operating environment for Chinese banks, raising new obstacles to sustained profitability, effective risk management and competitive operational efficiency.

Despite these challenges, CITIC Bank continued to make some achievements during the year through enhancements to the integrated service capabilities and the overhaul of the retail banking business, resulting in an improved revenue structure and greater profitability. To improve the capital allocation, the bank focused growth in off-balance sheet financing and other capital-light businesses. More stringent risk management and disciplined control also kept the asset quality manageable in 2016.

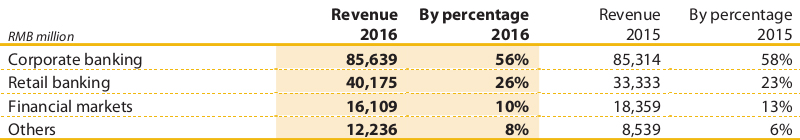

Even with the replacement of the business tax with a value-added tax during 2016, revenue was recorded at RMB154.2 billion, a year-on-year increase of 6%. The income mix was further improved with the growing non- interest income while the increasing total interest-earning assets largely offset the impact from the narrowed margin. After the impairment for non-performing loans was increased, profit attributable to ordinary shareholders was RMB41.6 billion, up slightly 1% over last year.

Corporate banking

As CITIC Bank’s main revenue contributor, corporate banking generated 56% of total revenue last year. Corporate loans and corporate deposits continued to grow steadily, ending the year, up 4% year-to-date at RMB1,846.3 billion and up 17% at RMB3,081.3 billion, respectively. In terms of total volume, both these figures gave the bank a first-place ranking among joint-stock banks 1 in 2016.

During the year, CITIC Bank closely aligned itself with macroeconomic policies to support the development of the real economy in China. It also improved the credit profile by increasing the bank’s exposure to top global and Chinese businesses, as well as industry leaders.

Capitalising on opportunities emerging from Chinese companies’ Go Global strategies, the bank also provided financing for several important international M&A transactions, acting as the pioneer of the market.

Retail banking

The revenue contribution from retail banking again increased during the year as a result of productivity gains from the ongoing transformation of this business. Revenue grew by 21% to reach RMB40.2 billion, accounting for 26% of total revenue.

As at the end of 2016, CITIC Bank deepened its exposure to more profitable customer segments, increasing the pool of medium- and high-end customers by 21% to 504,500. The number of private banking customers, meanwhile, grew to over 22,000, up 31% year-on-year. Through the renewed focus on these customer segments, the business had largely optimised returns on its service capacity by the end of the year. AUM and individual loans in 2016 exceeded RMB1.3 trillion and RMB950 billion, respectively, while revenue in the credit card business hit a historical high of RMB25.5 billion, up 36% from 2015. Popular services like Going-abroad Finance and collateral loans pledged by house also continued to grow.

In internet finance, CITIC Bank made several breakthroughs over the year. It led the establishment of a new “Online Finance Alliance”, a shared platform of 11 commercial banks, while continuing to deepen its collaboration with JD.com and develop the Baidu-partnered Baixin Bank. In 2017, Baixin Bank was approved by the China Banking Regulatory Commission as an independent legal entity to offer direct banking service.

CITIC Bank also enhanced its digital capabilities throughout the year, particularly the mobile platform. To upgrade the online customer service capabilities, it launched a new and improved website while added centralised payment and other integrated functions. In addition, it introduced new online payment products such as E-pos, CITIC e-pay and Cross-border pay. As a result of these improvements, the total volume of CITIC Bank’s online customer base, online sales penetration and digital revenue contribution rose over the year. On the back of all this growth, the bank also improved the utilisation of data analytics to develop a more targeted digital marketing capability.

Across its branch network, CITIC Bank improved the cost structure and introduced new services, including self- service, at various facilities, in line with the strategy of optimising the offerings of each branch location and its unique local customer profile. The overall streamlined processes helped reduce costs while improving the customer experience and service efficiency.

Financial markets

CITIC Bank’s financial markets business is focused on monetary, capital and international financial markets. Products and services include bond market-making and underwriting, foreign currencies, currency trading, interbank market, bank bill, and wealth management products, as well as a range of other specialised investment and financing offers.

Amidst rapid changes taking place in financial markets during the year, the bank reduced the exposure to increasingly low-yield, high-risk assets. Leveraging its network, funds, expertise and brand, it expanded the offerings among services promising higher returns, particularly in relation to the foreign exchange and interbank wealth management products.

In 2016, the financial markets arm of CITIC Bank enjoyed a leading market position among China’s joint-stock banks in 2016 in terms of turnover of foreign exchange spot trading, balance of international payments, AUM of bank bills, and turnover of electronic billing. CITIC Bank was named as market maker in direct trading of Chinese Yuan Renminbi to South African Rand, Canadian Dollar, Danish Krone, Norwegian Krone, covering the domestic interbank market of less actively traded currencies and further improving our leading position in this market. In addition, CITIC Bank’s Asset Management Business Center was formally established as a platform for cooperation with over 200 institutional clients comprising securities firms, insurance companies and trust companies.

1 Including China CITIC Bank, China Merchants Bank, China Minsheng Bank, Industrial Bank, Shanghai Pudong Development Bank, China Everbright Bank, Huaxia Bank, Ping’an Bank, Guangdong Development Bank, China Zheshang Bank, China Bohai Bank and Evergrowing Bank.