Business and Financial Review

Financial Review

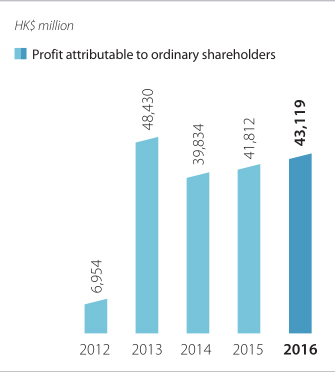

Profit attributable to ordinary shareholders

During 2016, the Group achieved net profit attributable to ordinary shareholders of HK$43,119 million, an increase of HK$1,307 million, or 3% from 2015. It included a gain of HK$10,337 million from the transfer of interests in certain domestic residential real estate projects held respectively by CITIC Real Estate and CITIC Pacific to China Overseas Land & Investment Limited, and an after tax impairment charge of HK$7,223 million taken on the Sino Iron Project. Excluding the impact of translation into Hong Kong dollars, the Company’s reporting currency, resulting from the depreciation of Renminbi during the period given CITIC Limited’s main operations and assets are in mainland China, an increase would have been HK$3,718 million, or 9% from 2015.

The financial services segment recorded net profit attributable to ordinary shareholders of HK$38,406 million. Excluding the gains recognised for the same period last year as a result of the disposal of equity interest in CITIC Securities and the dilution of CITIC Limited following the placing of new shares by CITIC Securities, the decrease in percentage of the Group’s shareholdings in CITIC Bank, as well as the impact of translation due to RMB depreciation, the decrease from 2015 would have been HK$1.4 billion or 3%.The banking business experienced a slowdown in growth in net profit as a result of the increase in provision, but it remained the principal source of profit for the financial services segment. Following RMB depreciation and the introduction of China National Tobacco Corporation as a strategic investor of CITIC Bank, the percentage of the Group’s shareholdings in CITIC Bank decreased as compared to the same period last year, resulting in a corresponding 8% decrease in net profit of CITIC Bank attributable to the Group. The trust business maintained stable performance, while the insurance business achieved rapid growth. The net profit increased 83% from 2015. The securities business experienced a significant decline in results in line with the overall conditions of China’s securities market from 2015.

For the non-financial segments, the manufacturing business achieved net profit attributable to ordinary shareholders of HK$1,740 million, a decrease of HK$756 million, or 30% from 2015, mainly due to the weaker market demand in the heavy machinery business, and the increase in provision. The engineering contracting business recorded net profit attributable to ordinary shareholders of HK$1,675 million, representing a year-on-year decrease of HK$926 million or 36%, mainly because the project was in the inception stage. The resources and energy business reported to reduce loss of HK$10,352 million as a result of the improvements in the crude oil business and bulk commodity trade business, the Company’s greater effort in cost reduction and efficiency enhancement, as well as the decrease in impairment loss of assets.

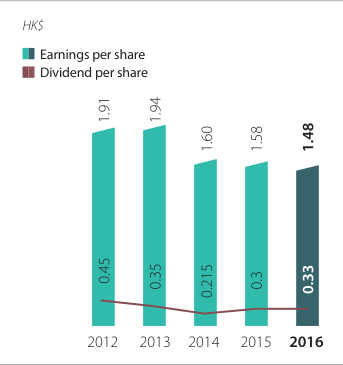

Earnings per share and dividends

Earnings per share of profit attributable to ordinary shareholders was HK$1.48 in 2016, a decrease of 6% from HK$1.58 in 2015. As at 31 December 2016, the number of ordinary shares outstanding was 29,090,262,630.

At the forthcoming annual general meeting, the Board will recommend a final dividend of HK$0.23 per share to ordinary shareholders. Together with the interim dividend of HK$0.10 per share paid in September 2016, the total ordinary dividend will be HK$0.33 (2015: HK$0.30 per share). This equates to an aggregate cash distribution of HK$9,600 million.

Profit/(loss) and assets by business

| YProfit/(loss) For the year ended 31 December |

Assets as at 31 December |

|||

|---|---|---|---|---|

| HK$ million | 2016 | 2015 (Restated) |

2016 | 2015 (Restated) |

| Financial services | 55,498 | 70,183 | 6,729,902 | 6,211,176 |

| Resources and energy | (6,522) | (18,318) | 135,784 | 141,693 |

| Manufacturing | 1,310 | 2,624 | 96,112 | 97,208 |

| Engineering contracting | 1,673 | 2,601 | 36,796 | 42,245 |

| Real estate | 2,264 | 2,820 | 143,596 | 232,809 |

| Others | 3,218 | 3,600 | 113,090 | 113,738 |

| Total | 57,441 | 63,510 | 7,255,280 | 6,838,869 |

| Operation management | (4,698) | (5,072) | ||

| Discontinued operations | 10,309 | 1,472 | ||

| Elimination | (413) | 783 | ||

| Profit attributable to non-controlling interests and holders of perpetual capital securities |

19,520 | 18,881 | ||

| Profit attributable to ordinary shareholders | 43,119 | 41,812 | ||

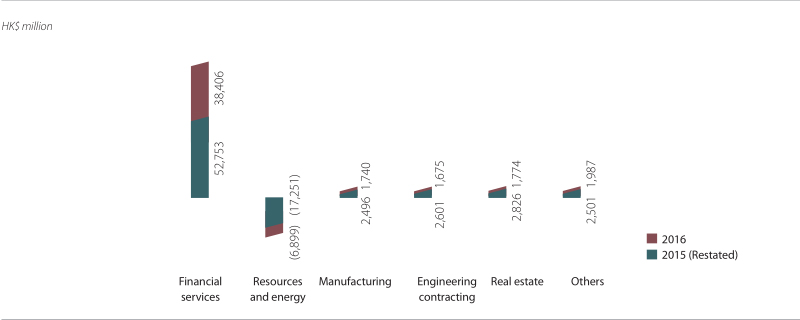

Profit/(loss) attributable to ordinary shareholders from continuing operations by business

Financial services:

In 2016, the financial services segment recorded net profit attributable to ordinary shareholders of HK$38,406 million. Excluding the gains recognised for the same period last year as a result of the disposal of equity interests in CITIC Securities, the dilution of CITIC Limited’s equity interests following the placing of new shares by CITIC Securities and the decrease in shareholding in CITIC Bank by the Group, as well as the impact of translation due to RMB depreciation, the decrease from 2015 would have been HK$1.4 billion or 3%.

The banking business reported growth in net profit and remained the principal source of profit for the financial services segment. CITIC Bank continued to optimize its revenue mix and percentage share of the non-interest income increasingly expanded, and the increase in size of the non-interest income and the interest-bearing assets led to an increase in net profit over 2015. Following the impact of translation due to RMB depreciation, the introduction of China National Tobacco Corporation as a strategic investor of CITIC Bank, the percentage of the Group’s shareholdings in CITIC Bank decreased as compared to last year, resulting in a corresponding 8% decrease in net profit of CITIC Bank attributable to the Group. The trust business reported stable performance in 2016, the size of its asset management has been ranked no. 1 in the industry for consecutive 10 years. The securities business has been affected by the general securities market in China, reporting a decrease in profit by 48%. The insurance business has grown rapidly with an increase in profit by 83%.

Resources and energy:

International demand for bulk commodities and energy has been increasing in 2016. Price of crude oil was still at a historical low even though it rose in 2016, having greater impact on the Group’s crude oil business. The rise in coal price and the decline of the on-grid electricity price have made adverse impact on the Group’s power generation business.

The resources and energy business recorded a loss of HK$6,899 million in 2016, representing a decrease in loss of HK$10,352 million as compared to last year. In particular, the Company made an impairment provision of approximately HK$7,223 million (net of tax) following a valuation appraisal conducted for the Sino Iron Project principally due to downward adjustment of forward price forecast of iron ore by independent institutions regardless of recent increase in iron ore spot price. Loss recorded in the crude oil business has significantly reduced as compared to last year due to decrease in taxes and dues as well as costs control. The power generation business continued to generate stable cash flow to the Company. The Las Bambas copper mine project in Peru, in which CITIC Metal holds a 15% interest, has made profit contribution to the Group upon the commencement of commercial production.

CITIC Limited carried out a merger combining its two principal subsidiaries engaging resources and energy business, namely CITIC Metal and CITIC United Asia, by setting up CITIC Metal Group Limited in order to strengthen its competitiveness and investment return in mining investment and bulk commodities trading. The Sino Iron Project passed an important milestone in 2016 that all six production lines of the Sino Iron Project have been in operation with approximately 11 million wet metric tonnes of concentrate produced for export in 2016.

Manufacturing:

The manufacturing business recorded net profit attributable to ordinary shareholders of HK$1,740 million in 2016, representing a decrease of HK$756 million or 30% from 2015. Owing to the focus on higher margin products, and an optimised procurement strategy to manage raw material cost, net profit of special steel business increased over 20% compared with 2015, excluding the impairment recorded in 2015. CITIC Dicastal recorded an increase in net profit by 21% over 2015 due to relatively rapid growth in sales of aluminium wheels and castings encouraged by increase in global and domestic demand for automobiles. However, the heavy equipment recorded a significant loss in 2016 due to reduction of demand from downstream sector, resulting in limited effectiveness achieved from new business investment, as well as the effect of impairment provision for inventory.

Engineering contracting:

The engineering contracting segment recorded net profit attributable to ordinary shareholders of HK$1,675 million, a decrease of HK$926 million from 2015. Such decrease was principally due to all new projects at initial stage or in phase of contract negotiation, but was partially offset by collection of amounts due from the Algerian expressway project.

Real Estate:

The Group recorded a gain of HK$10.3 billion from the disposal of interest in certain residential real estate projects in the PRC held by CITIC Corporation and CITIC Pacific respectively to China Overseas Land & Investment Limited, and the operating results and cash flow of the items were presented under the discontinued operations of the Group. For details, please refer to notes 17(a) and 50 to the financial statements.

For continued operations of the Group, the real estate business recorded a decline in profit due to the gains from the sales of Royal Pavilion (華山公寓) in 2015 and a decrease in gains from the revaluation of investment properties in 2016. The average occupancy rate for investment properties was approximately 95% as at 31 December 2016, which was comparable with preceding years.

Others:

Others segment recorded net profit attributable to ordinary shareholders of HK$1,987 million in 2016, a decrease of HK$514 million from 2015. The infrastructure business, such as expressways and ports, and the international telecommunications service business continued to generate stable profit and cash flow. Dah Chong Hong recorded a decline in profit due to weak performance of food business and consumer goods in China.

CITIC Envirotech, a company listed on the Mainboard of the Singapore Exchange Securities Trading Limited of which controlling stakes were acquired by the Group on 24 April 2015, reported substantial year- on-year growth in net profit in 2016 after expanding its EPC, water treatment and membrane product businesses.