Special Feature: CITIC Trust

Risk Management

Risk management framework

As a pioneer of financial innovation in China, CITIC Trust has consistently been a first-mover in the financial industry. Nevertheless, based on a client’s risk appetite, a moderate risk exposure is maintained with risk managed through a range of integrated resources and tools. The ultimate goal is to maximise value for clients and strike a balance between business growth and quality.

As most trust products are not standardised, CITIC Trust’s comprehensive risk system has strong internal controls across each of the front, middle office and back offices — a system known as the “three lines of defence.” The front office comprises the advisory and customer service teams; the middle office includes compliance personnel across the finance and legal functions; and the back office is composed of audit teams who review historical decisions and activity. As a result, the company is able to maintain a robust system of controls and monitoring at all stages of project development across all functions and service offerings.

CITIC Trust also maintain a comprehensive corporate governance system with a board of directors, board of supervisors and senior management, who collaborate to embed risk-readiness and effective risk governance into all decision-making activities and operational management.

Solid Capital

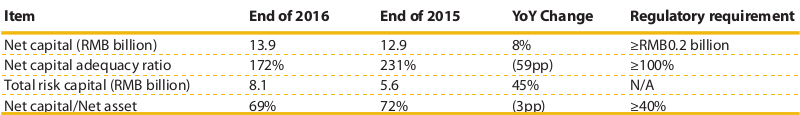

The Measures for the Administration of Net Capital of Trust Companies came into force in 2010, which improved the regulatory framework for the trust industry. The regulation calls for trust companies to adopt more stringent risk management and focus on the light capital business itself. CITIC Trust’s capital remained strong and stable during the year. As of the end of 2016, CITIC Trust’s registered capital was RMB10 billion. Its net capital adequacy ratio remained stable at 172%, while the net capital of the company was RMB13.9 billion, both much higher than the regulatory requirements. This solid capital provides buffers and helps to absorb losses for long-term growth and business innovation.