Special Feature: CITIC Trust

Key Service and Products

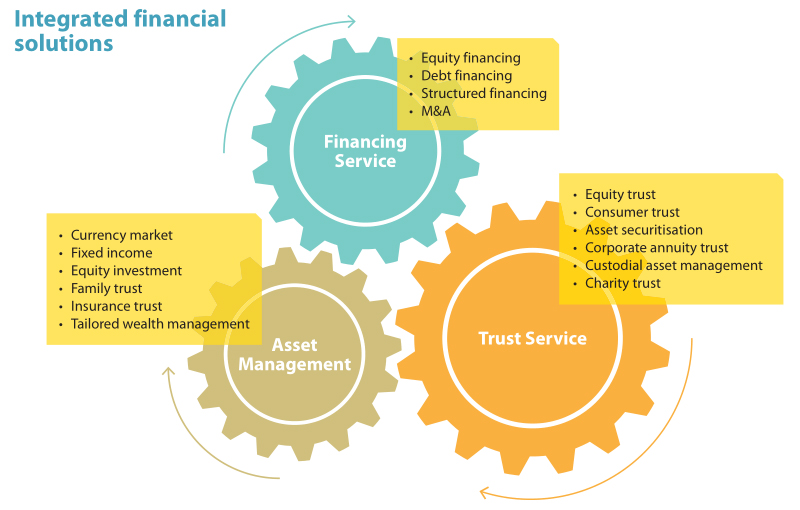

At the core of its business, CITIC Trust acts as a bridge between the financing and investment needs of clients. In effect, the company acts as an integrated platform to enable more efficient capital and asset allocation for each side of its client base. It offers main services across financing, asset management and trust service.

Financing: CITIC Trust delivers flexible financing solutions to clients, such as government, enterprises, financial institutions and other institutional investors, by leveraging various debt and equity financing instruments to efficiently connect them with appropriate investors selected among the company’s wide network of high net worth individuals and institutional asset management clients. In this business, several products and services are provided, such as equity financing, debt financing, structured financing and M&A. The PPP business is another example of CITIC Trust’s ability to provide an integrated financing service.

Asset management: CITIC Trust provides diversified wealth management services to high net worth individuals and institutional clients, differentiated by the company’s presence across multiple financial markets and industries on its integrated platform. As a result, clients enjoy market-leading investment opportunities and tailored wealth management solutions. A wide range of investment products is distributed across currency markets, fixed income and equity investment, segmented into a number of well- defined categories such as family trust, insurance trust and tailored wealth management.

Trust service: Clients’ assets are typically held in trust structures, with CITIC Trust providing a consulting and management service to solve issues such as asset isolation, liquidity and custody. Specific services include equity trust, consumer trust, asset securitisation, corporate annuity trust, custodial account management and charity trust. The experience, knowledge and expertise of the company’s professional team in accounting, legal, tax and financial services are unparalleled. This business, with its light capital consumption model, will likely continue driving the company’s long-term development and is already providing fee income that has become a major revenue contributor for the company.

Highlighted services and products pioneered by CITIC Trust

Family Trust

Since 2013, CITIC Trust has provided family trust services to high net worth customers, allowing them to enjoy the cross-generational financial benefits of a privately and independently managed trust. In 2016, the company officially introduced a new brand to deliver these integrated services, CITIC Family Trust.

CITIC provides two kinds of family trust services — a customised service requiring a minimum AUM of RMB30 million and a standard service with minimum AUM of RMB6 million. In addition, products such as Insurance Trust have been set up with CITIC-Prudential, a subsidiary of CITIC Limited, to cater for the unique needs of family trust clients. The team includes financial advisors, lawyers, accountants and trust specialists, who provide integrated wealth management solutions. As of the end of 2016, over 650 clients with total AUM of approximately RMB6 billion had opened accounts with CITIC Trust, making its family trust service the largest among trust companies in China. Family Trust Services will become a sustainable income contributor over the long term for CITIC Trust.

Public-Private Partnerships (PPP)

In recent years, the Central Government of China has been vigorously promoting the PPP model to raise funds for a growing number of infrastructure projects across the country. CITIC Trust provides a one-stop solution for PPP projects, using the CITIC Limited platform and CITIC Trust’s expertise in infrastructure projects.

In 2015, CITIC Trust became the first trust company to launch a PPP project, raising RMB608 million for investing in the Tangshan International Horticultural Exhibition in Tang Shan, Hebei Province. In 2016, CITIC Trust was also the fund manager for Guizhou Province’s PPP Fund, with a fund size of RMB10 billion. China International Economic Consultants, with its operations managed by CITIC Trust, was also one of the first PPP consulting companies recommended by China’s Ministry of Finance to provide legislative services, project review and database compilation for PPP projects.

Asset Securitisation Products

CITIC Trust was one of the first regulator-approved trust companies in China to develop an asset securitisation business. By 2016, the accumulative size of this business exceeded RMB230 billion, ranking the first within the trust industry. It is also working to expand the scope of applicable underlying corporate assets to include non-bank lending assets, financial leasing assets, rights to beneficial interests of infrastructure, and accounts receivable.

In 2015, CITIC Trust successfully completed the first domestic corporate asset securitisation backed by commercial property rental income as the underlying asset — CITIC-Maoyong — which has since been listed on the Shenzhen Stock Exchange.

Consumer Trust Products

Consumer Trust Products was launched to meet emerging consumer demand in China. Its products give clients greater exposure to CITIC Trust’s cross fund for investing in a wide range of industries. The industries covered under this product line include film, tourism, pensions, gold and diamonds, and high-end medical services.

CITIC Trust cooperates with domestic internet giants such as Baidu, Ant Financial, and NetEase to integrate online and offline consumer trust product pilot activities under the emerging Internet + Finance + Consumer model. In 2015, CITIC Trust also rolled out the first trust product in China’s diamond trade — a new, experimental investment model in the rigid diamond investment industry. The offering enabled investors to share in both investment and collection opportunities. In 2016, the company launched an online monetary fund, Le Mai Bao, which quickly reached RMB2.2 billion.

Overseas Businesses

With the increasing internationalisation of the RMB, a growing need has emerged for overseas asset allocation among high net worth customers who wish to diversify their portfolios. CITIC Trust has therefore seized the opportunity to expand its businesses overseas through subsidiary CTI Capital Management as a platform for offshore business. The company is the first in the trust industry approved by China Banking Regulatory Commission to enter overseas markets. In 2015, CTI provided structured financing of HK$1.4 billion to support the “going out” strategy of Chinese companies. Another product, the Global Opportunities Fund, was the first offshore hedge fund established by a Chinese trust company. Additionally, CRC (Yunnan) Capital Management, a company founded by CITIC Trust’s wholly-owned subsidiary CITIC Juxin, provides overseas direct Renminbi investment and overseas lending services. CITIC Trust also bridges domestic investors and the offshore market through several Qualified Domestic Institutional Investor ("QDII") projects.