Financial Services

CITIC-Prudential

CITIC-Prudential is a fifty-fifty joint venture between CITIC Corporation Limited and Prudential Corporation Holdings Limited, offering life, health and accident insurance, as well as reinsurance services. As of the end of 2016, CITIC-Prudential had a total of 167 branches in 67 cities across China.

Year in review

The role of commercial insurance in China continued to grow in 2016, driven by the ongoing maturation of the Chinese economy, accelerating supply-side reform and a rapidly aging population. Innovation within the industry also gathered pace as new applications for data analytics and an emerging consumer appetite for buying insurance products online created a boom in new products and consumer-facing platforms. Additionally, risks associated with capital usage increased against the background of an economic downturn and falling interest rates. Accordingly, the nature of insurance industry — hedging against the risk of losses, has been re-addressed by the Chinese Insurance Regulatory Commission.

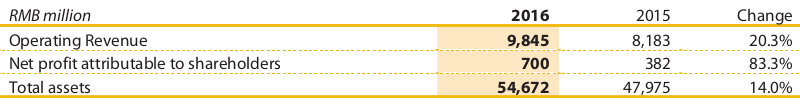

In this market environment, CITIC-Prudential achieved solid growth across all business segments for the year, while accelerating reform and innovation. Operating revenue was RMB9.8 billion, representing an increase of 20%, while total assets were RMB54.7 billion, up 14% year-on-year. Despite an overall downturn in industry performance in 2016, net profit grew by 83% to reach RMB700 million.

Another key strategic focus for CITIC-Prudential in 2016 was to optimise risk management. After successfully implementing a new framework for managing solvency risks, we received “A” grades in Integrated Risk Rating for Q1 to Q4 2016.

Products

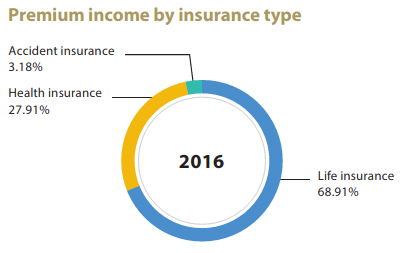

CITIC-Prudential’s core businesses offer life and health insurance, complemented by accident insurance and asset management services. For the year 2016, the company recorded total premium income RMB8.2 billion, increased by 32% and premium income RMB5.7 billion in its life insurance business, representing an annual increase of 25%. Health insurance premium income, meanwhile, reached RMB2.3billion, an increase of 59% year-on-year, and the proportion increased by 4.7%.

CITIC-Prudential achieved growth in terms of both premium income and embedded value, the company achieved growth by adding more HNWI clients to its traditional customer base through product mix optimisation. The development of long-term protection products was further enhanced in the agency channel and, in a successful brand-building exercise for CITIC-Prudential, upgraded primary health products to reinforce its leading position in this market. In bancassurance, the company remodelled this channel for value enhancement and scaled down the business in short or medium duration products. Thanks to stronger efforts to the development and promotion of regular-pay products, the proportion of regular-pay business increased significantly thus achieving stable value.

Distribution

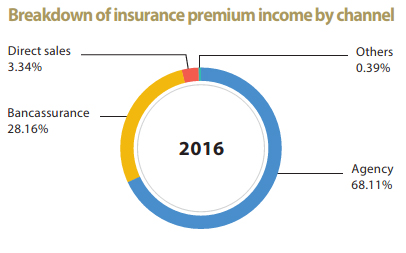

Agency and bancassurance are CITIC-Prudential’s two primary distribution channels. In 2016, CITIC- Prudential grew its agency force substantially, ending the year with 33,075 agents for an annual increase of 51%. Insurance premium income from the agency channel was also strong, accounting for 68% of CITIC- Prudential’s total premium income of RMB5.6 billion, and the proportion increased by 0.59%. Although still in the initial stage, remodelling the bancassurance channel business has been successful as a result of the significant optimisation of the product mix. Moreover, insurance premiums from first year regular-pay premium increased from 9% in 2015 to 39% as a percentage of total income. Breakthroughs were also made in new bancassurance partnerships with Agricultural Bank of China and Minsheng Bank, while strategic partnerships were expanded with CITIC Bank and Standard Chartered Bank. In the e-commerce channel, we further standardised processes in accordance with regulatory procedures and established internet business management platform.