Financial Services

CITIC Trust

CITIC Trust is the largest trust company in China with total trust assets under management (AUM) of over RMB1,764 billion as at the end of 2016, a year-on-year growth of 27%. For past 10 consecutive years, the company has been the country’s largest trust provider in terms of total AUM.

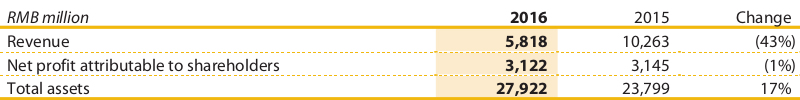

Organic growth remained stable through 2016 and generated revenue of RMB5.8 billion in 2016, representing a year-on-year decrease of 2% if excluding the one-off investment gain from the sale of Taikang Insurance’s equity. The decline was mainly due to the year-on-year reduction in investment gain under its proprietary business. Net profit attributable to shareholders amounted to RMB3.1 billion, largely stable compared to last year while the trust profit attributable to beneficiaries was RMB56.1 billion.

The net capital adequacy ratio remained solid at 172% at the end of 2016 while net capital of the company was RMB13.9 billion, both much higher than the regulatory requirements.

Year in review

The company has been able to maintain its leading position because of the comprehensive range of integrated solutions it offers across financing, asset management and trust services. Clients are primarily institutional investors and wealthy individuals. CITIC Trust’s businesses consist of client-facing trust business, as well as a proprietary business and a range of specialised subsidiaries.

- The trust business offers financing, investment and asset management across financial market and industrial market under trust law. As of the end of 2016, trust assets amounted to RMB1,424.9 billion, an increase of 39% over the previous year. In 2016, revenue from the trust business reached RMB4.3 billion, comprising 74% of total revenue.

- The proprietary business provides sufficient liquidity for and serves as a cornerstone for the trust business by effectively managing internal capital utilisation. As of the end of 2016, proprietary assets amounted to RMB27.9 billion, representing an increase of 17% over the previous year.

- Specialised subsidiaries aim to explore and increase CITIC Trust’s exposure to asset management, overseas businesses and consulting service in order to provide synergies and add value for the core business.

In response to the asset shortage in 2016, CITIC Trust continued to innovate, creating a new growth engine. The company introduced a new brand “CITIC Family Trust” and launched its first cross-border employee stock ownership trust in China. It also was nominated as the fund manager for Guizhou Province’s PPP Fund with the fund size of RMB10 billion. With all of these achievements, the company was recognised as the most innovative trust company in China.