Special Feature: CITIC Trust

Innovation: Our Key to Success

ZHAO Na

Vice President of CITIC Trust

Innovation, the core of our success

As China’s financial system continues to modernise, the trust industry today faces both great opportunity and challenge. The demand for innovative new products and services is growing like never before, and the sector is well positioned to lead financial innovation by integrating the majority of financial instruments. As the top player in this industry, we see innovation as the key to our success. But at the same time, increasing maturation is also driving greater regulation. As a result, delivering true innovation has become more complex and time-sensitive. Facing the challenges of the changing market environment, tightening regulations and growing time-sensitivity for delivering true innovation, we are stepping up the pace of exploring new fields and continuing to lead the industry.

Persistent improvement

Our PPP business is a good example of how we navigate this area under our trust structure. Starting from 2014, we strike a balance between fairness and efficiency by assembling the funds to invest in PPP projects. In 2015, we were the first mover among trust firms in this market, launching the industry’s first PPP project when we invested in the Tangshan International Horticultural Exhibition — a demonstration PPP project of the Ministry of Finance. Since then, we have successfully participated in several other large projects, including the launch of a PPP investment fund with the municipal government of Ningbo, fund management for Guizhou Province’s PPP fund, and investment in the Huangshi Olympics Sports Center PPP project in Hubei Province, the first sports-related PPP project in China. Although the market is becoming more competitive, I am proud to say that from Tangshan to Huangshi, our PPP expertise has advanced considerably in terms of partner selection, financing solutions, transaction structure and risk management.

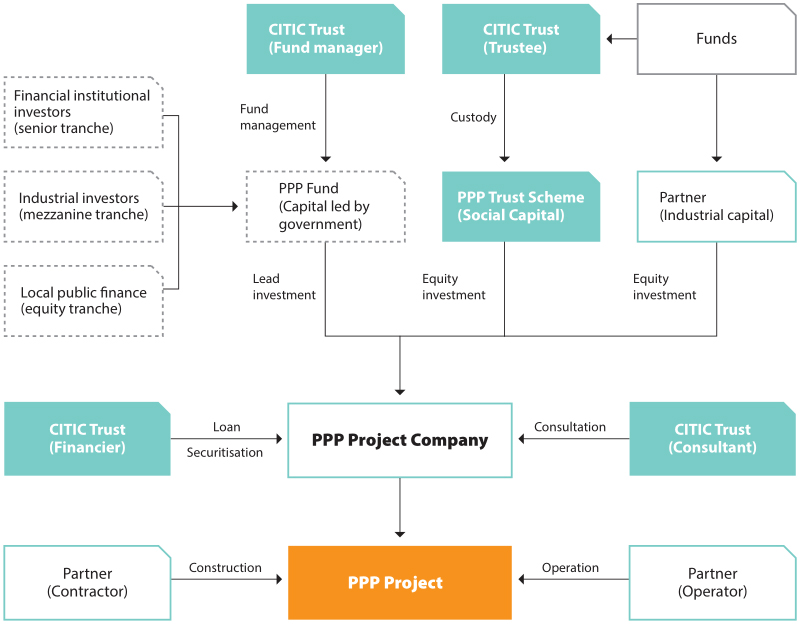

PPP consortiums, a win-win for all

Most PPP projects cut across a wide range of areas, requiring specific knowledge and very long investment horizons. These projects are rather complicated in terms of bidding, financing, construction, operation and securitisation. At CITIC Trust, we have the ability to form PPP consortiums with large contractors and professional operators for project bids, which plays up our collective strength in comparison to single entity bidders. It should be noted that through these consortium arrangements, each party enjoys the benefits and shares the risks.

A supermarket of financial instruments

We utilise not only assembled funds to invest in PPP projects but also other instruments, such as limited partnerships, contractual type funds, asset-backed securities (ABS) and asset-backed notes (ABN).

Greater flexibility to invest through equity and debt

We can take advantage of our flexibility by investing with a combination of equity and debt to satisfy different financing needs. For the projects in which we invest, CITIC Trust acts as the shareholder as well as the financier for the project companies. This hybrid financing solution helps us control the core assets and interests of the PPP project, while lowering the risks of refinancing to ensure timely project completion.

Securitization as an exit strategy

There is always some uncertainty when developing PPP projects due to their long investment horizons. Thus, the exit strategy is always the key challenge. In order to solve this problem, we use our expertise to securitise the PPP assets and list them in the secondary market. Through this exit mechanism, we can provide a one-stop service that spans financing, investment, management and cashing out.

Leveraging our platform to build a CITIC PPP consortium

CITIC Trust is at the forefront of the PPP market. Under the umbrella of CITIC Limited, we have access to unparalleled industrial and capital resources, not to mention the constant potential for cross-business synergy in finance, manufacturing, engineering contracting and energy. We plan to get even better at this as we build up a CITIC PPP consortium to lead the market even further than today.

Staying dynamic

PPP is just one of the many areas where we lead in innovation and the most recent example of our constant commitment at CITIC Trust to staying dynamic, being agile and striving always to deliver truly integrated financial solutions.

An example of PPP project structure

What is PPP?

PPP (Public-Private Partnership) projects are cooperative ventures between public and private sector actors to deliver infrastructure and public works initiatives. These arrangements are mutually beneficial for all parties as private companies drive the projects and ensure efficient, profitable and professional management, while local governments focus on solving public service challenges. With the emergence of this type of project structure, private capital can flow into attractive infrastructure projects more efficiently, while local governments can gain access to the capital they need to finance their development priorities while relaxing their debt burden. PPP is a national policy priority in China.

Following the first Chinese PPP projects in the 1980s, they have reappeared on a much greater scale in recent years, particularly since 2015, in response to accelerating urbanisation and other factors related to rapid economic development. Participating in PPP projects by leveraging trust funds is an innovative model that has been recognised by the Ministry of Finance.