Financial Review

Overview

Profit Attributable to Ordinary Shareholders

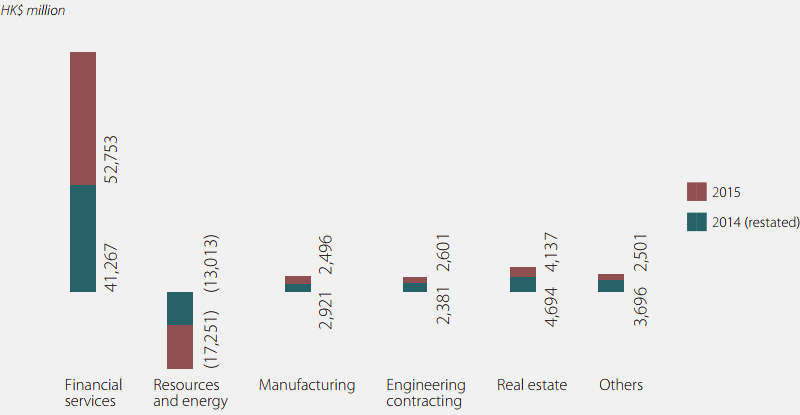

During 2015, the group achieved profit attributable to ordinary shareholders of HK$41,812 million, an increase of HK$1,978 million, or 5% year-on-year. The financial services segment recorded profit attributable to ordinary shareholders of HK$52,753 million, an increase of HK$11,486 million, or 28% above 2014. Excluding gains on the disposal of 3.16% equity interest and placing of new shares of CITIC Securities, profit from banking business grew slightly due to an increase in the impairment provisions on loans. Attributable profit from trust, insurance and securities business achieved growth.

For the non-financial segment, real estate business recorded profit attributable to ordinary shareholders of HK$4,137 million, a decrease of HK$557 million, or 12%, mainly due to a decrease in revaluation gain of investment properties and booking of completed properties. Attributable profit from engineering contracting business was HK$2,601 million. As a result of weaker market demand, the manufacturing business profit attributable to ordinary shareholders of the manufacturing business decreased by 15% to HK$2,496 million. The attributable loss of resources and energy business expanded HK$4,238 million , or 33% compared with 2014, reflecting impairment loss provision on CITIC Resources’ assets due to persistent depressed oil and commodities prices.

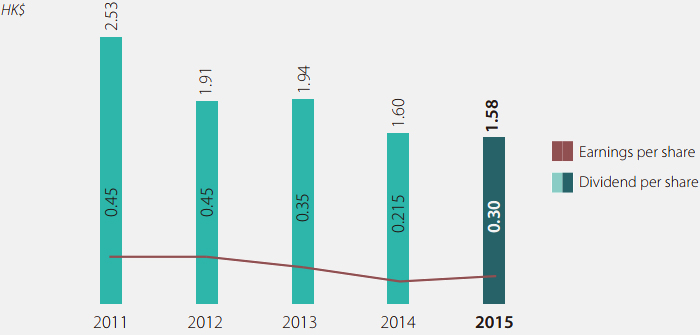

Earnings per Share and Dividends

Earnings per share of profit attributable to ordinary shareholders was HK$1.58, a decrease of 1.3% from HK$1.60 in 2014. As at 31 December 2015, the number of ordinary shares outstanding was 29,090,262,630.

At the forthcoming annual general meeting, the Board will recommend a final dividend of HK$0.20 per share to ordinary shareholders. Together with the interim dividend of HK$0.10 per share paid in October 2015, the total ordinary dividend will be HK$0.30 per share (2014: HK$0.215 per share). This equates to an aggregate cash distribution of HK$8,727 million.

Profit/(loss) and assets by business

| Profit/(loss) | Assets as at 31 December | Return on assets (note) | ||||

|---|---|---|---|---|---|---|

| In HK$ million | 2015 | 2014 (Restated) |

2015 | 2014 (Restated) |

2015 | 2014 (Restated) |

| Financial services | 70,183 | 59,016 | 6,211,176 | 5,322,510 | 1% | 1% |

| Resources and energy | (18,318) | (13,613) | 141,693 | 147,903 | (13%) | (9%) |

| Manufacturing | 2,624 | 3,354 | 97,208 | 108,501 | 3% | 3% |

| Engineering contracting | 2,601 | 2,384 | 42,245 | 44,020 | 6% | 5% |

| Real estate | 4,292 | 5,107 | 232,809 | 215,095 | 2% | 2% |

| Others | 3,600 | 4,534 | 113,738 | 97,373 | 3% | 5% |

| Underlying business operations | 64,982 | 60,782 | 6,838,869 | 5,935,402 | ||

| Operation management | (5,072) | (2,504) | ||||

| Elimination | 783 | 1,522 | ||||

| Profit attributable to non-controlling interests and holders of perpetual capital securities | 18,881 | 19,966 | ||||

| Profit attributable to ordinary shareholders | 41,812 | 39,834 | ||||

Profit/(loss) Attributable to Ordinary Shareholders by Business

Financial services

This segment remains a major contributor to the Group’s profit and achieved attributable profit of HK$52,753 million in 2015. Excluding the gains from the disposal of 3.16% equity interest and placing of new shares of CITIC Securities, the financial services business performed steadily, largely due to the growth of trust and securities businesses, as well as the continuous growth in banking business. The net interest income increased for interest-earning assets growth and net non-interest income increased 36.6% owning to the growth of bank handling charges from credit card, agency and wealth management services. But this was partly offset by an increase in the impairment provision on loans in the banking business. Profit from the trust business grew steadily owing to the income from equity investment. Securities maintained the lead of the market, and achieved significant growth in both revenue and profit.

Resources and energy

The resources and energy segment experienced an extremely difficult operating environment and recorded an attributable loss of HK$17,251 million, which was HK$4,238 million more than the loss in 2014, reflecting a HK$12,480 million (after tax) impairment provision on the Sino Iron Project, primarily as a result of a decrease in the forecast iron ore price.

The Group’s other resources and energy interests were also affected to varying degrees by weaker overall demand for commodities and commodity prices, including manganese, aluminium and coal, as well as oversupply of crude oil, which was primarily reflected by the prevailing low level of Brent crude oil prices during 2015 since the drop in the second half of 2014. In addition, a number of substantial impairments across its assets was recorded, which result in the sharp drop of CITIC Resources performance.

Against this backdrop, processing lines three and four of Sino Iron began producing in the last quarter of 2015. Construction of the final two lines is expected to be completed on schedule with lines five and six targeted to begin commissioning in the first half of 2016, which will mark the end of the main construction task of Sino Iron. The Group also successfully obtained government approval to extend its existing right to explore, develop, produce and sell oil at the Karazhanbas oil field. In addition, the group improved the oil production of 3 oilfields and discovered material gas at Seram Block in Indonesia.

Manufacturing

This business recorded a decrease in attributable profit to HK$2,496 million. The continuing growth in sales volume of aluminium wheels has driven a steady growth in net revenue. Profit from special steel business decreased in 2015 due to a decline in price of steel weak market demand and an asset impairment loss, but the profitability of us was still leading the market. Heavy machinery business experienced a significant drop in profit due to the weaker demand for machinery from traditional industries, such as mining, construction materials and coal.

Engineering contracting

In 2015, attributable profit of the engineering contracting segment increased to HK$2,601 million. It was due primarily to the contribution margin rate increase for Angola RED project. This was partially offset as Angola KK project has entered its final stage, while new projects have not yet begun contributing significantly to profit growth.

Real estate

Profit attributable to ordinary shareholders decreased HK$557 million from the previous year, to HK$4,137 million. The reduction was primarily due to a decrease in revaluation gain on investment properties and a decrease in the bookings of completed properties. The average occupancy rate for investment properties was approximately 95% on 31 December 2015, which was comparable with preceding years.

Others

Profit attributable to ordinary shareholders of other businesses was HK$2,501 million in 2015. The major profit contributors were infrastructure business, such as tunnels and expressways, international telecommunication services, and Dah Chong Hong. The Group gained control over CITIC Envirotech, a company listed the Mainboard of the Singapore Exchange Securities Trading Limited, on 24 April 2015. Attributable profit of expressways maintained stable, while tunnels and international telecommunication business kept growth, but contribution from Dah Chong Hong dropped due to a decline in selling price of new car and sales volume of commercial vehicles in the PRC.