CITIC Securities

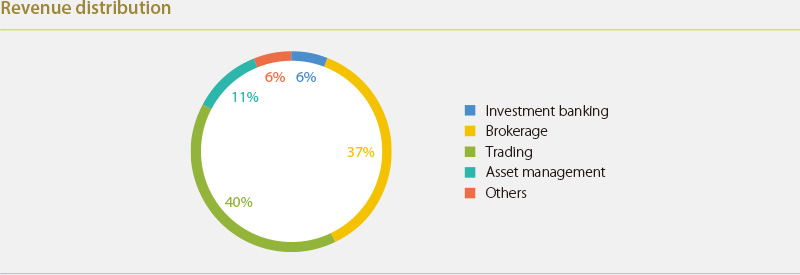

CITIC Securities is the largest securities company in China, with businesses covering investment banking, brokerage, securities trading and asset management.

Year in review

Trading volume in China’s A-share market saw dramatic growth and consistent volatility throughout 2015. Riding on this trend and leveraging its leading position in the industry, CITIC Securities’ brokerage services, asset management and investment banking businesses all posted significant growth as a result. For the year 2015, CITIC Securities recorded a net profit attributable to shareholders of RMB19.8 billion, a 75% increase over 2014.

The company also replenished capital through a non-public issuance of 1.1 billion new H shares.

Investment banking

CITIC Securities’ equity financing business continued to post significant growth in 2015, cementing the firm’s leadership over the A-share market. As the lead underwriter on transactions with an aggregate value of RMB177.3 billion, the business closed the year with a market share of 11%. Globally, CITIC Securities International also completed 15 IPOs, 24 re-financing projects, 19 offshore RMB bond and US dollar bond projects.

The company’s fixed income business, also the market leader in China, completed 321 projects with an aggregate value of RMB385.7 billion, in lead underwriting bonds, medium term notes, commercial papers and asset-backed securities, representing a market share of 3%, ranking first in the industry.

In mergers and acquisitions, CITIC Securities completed transactions with an aggregate value of US$70 billion, ranking it the top three global financial advisors for merger and acquisition transactions participated by Chinese companies.

CITIC Securities also established a new advisory service in 2015 for growth stage companies seeking to list on China’s over-the-counter market, the National Equities Exchange and Quotation (New Third Board) exchange. CITIC Securities underwrote the listing of 75 companies and provided market-making service for 104 companies.

Brokerage Services

The brokerage business continues to generate considerable profit for CITIC Securities, and high trading volume throughout the year contributed to strong revenue growth. CITIC Securities recorded a total trading turnover of RMB33.8 trillion in stocks and funds on the Shanghai Stock Exchange and Shenzhen Stock Exchange, with a market share of 6%.

Asset management

The asset management business continued to grow strongly in 2015: Total assets under management (AUM) amounted to RMB1.1 trillion at the end of the year, representing a market share of 10%. Among securities firms in China, CITIC Securities’ asset management business maintained the first ranking in terms of total AUM.

CITIC Securities is also the largest shareholder of China AMC, a leading asset management company with RMB864.4 billion under management as at the end of 2015, an increase of 89% over the previous year.

Trading

CITIC Securities’ trading business includes both flow-based business and proprietary trading.

For flow-based business, CITIC Securities provides its clients financial services such as equity flow-based business, fixed income, commodities and prime services. The balance of the margin financing and securities lending reached RMB74 billion, with a market share of 6%, making it the top in the market.

The company makes both proprietary trading and alternative investment. The Company strengthened its risk management protocols in 2015 by taking risk-to-revenue ratio as a mandatory criterion in investment decisions.