Real Estate

Repositioning mainland China property business

In March 2016, CITIC Limited announced the sale of a 100% equity interest in CITIC Real Estate, as well as the mainland residential property assets of CITIC Pacific, to China Overseas Land & Investment Limited (“COLI”).

The transaction value is estimated to be approximately RMB31 billion. Upon the completion of this transaction, CITIC will hold an approximately 10% equity stake in COLI and shall also receive additional assets whose value is estimated to be approximately RMB6 billion.

CITIC City Investment & Development Limited was set up to manage the property business going forward.

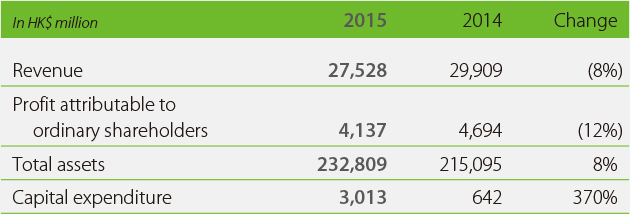

Year in review

In 2015, CITIC’s real estate business recorded revenue of HK$27.5 billion, a 8% decrease from 2014, attributable profit for ordinary shareholder also declined by 12% to HK$4.1 billion, caused primarily by the relative lack of new units available for delivery.

In residential property, sales have stayed flat amidst persistent overcapacity and weak demand. While the government implemented several significant policy changes in 2015 to stimulate housing demand and promote more sustainable development throughout the sector, these measures have had little immediate impact. Nevertheless, the continually loosening home purchase rules and easier access to credit are likely to improve residential property sales in the future.

In commercial property, competition continued to intensify. While we saw slight drops over the year in retail occupancy rates but slight rise in average rent in our Grade A office buildings such as Shanghai CITIC Square, we remain optimistic for the year ahead. All of our major commercial properties are in prime locations in first-tier cities. While occupants may change from year to year, we believe demand will remain stable over the long term.

In 2015, CITIC Limited’s real estate business sold a total of 2.15 million m2 of residential properties, mainly in projects in Beijing CITIC New Town, Tianjin City Plaza, Changchun CITIC Town, Nanhai CITIC Mountainside Lake, Qingpu Zhujiajiao New Town and Zhuhai Mangrove Bay.

In Hong Kong, the luxury residential project on Kadoorie Hill was topped out in mid-2015 and named KADOORIA. This project offers 77 high quality apartments and is scheduled for completion and for sale in 2016. Besides, CITIC acquired a residential site in Lok Wo Sha, with a gross floor area of approximately 21,000 m2, by way of a government tender in 2015. This project is scheduled for completion in 2019. For our Discovery Bay development project, which is 50% owned by CITIC, sales of Phase 15, Positano, continued in 2015. Construction of Phase 16, a high-rise development, is scheduled for completion in 2017.

Our Hong Kong investment property portfolio provided stable rental income in 2015, with an overall average occupancy of approximately 97%.

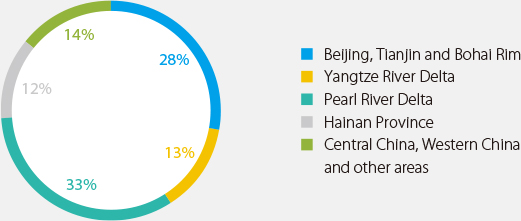

Land bank by geographical area

Total land bank: 19.28 million m2