CITIC-Prudential

CITIC-Prudential is a fifty-fifty joint venture between CITIC Limited and Prudential plc, offering life, health and accident insurance, as well as reinsurance for these insurance businesses. By the end of 2015, CITIC-Prudential had a total of 158 sales offices in 64 cities across China.

Year in review

New opportunities for the commercial insurance industry have arisen along with the deepening of the economic transformation in China, the launch of the Ten New Rules, i.e., new state policies for the insurance industry, the publication of Opinions on Accelerating the Development of Commercial Health Insurance, and the introduction of taxation and pension system reforms. In the new era of asset management, the widening of investment channels has made the insurance industry more competitive and attractive. Internet Plus, China’s proposed information super highway, has also triggered the rapid development of the industry. In 2015, premium income and industry profits grew significantly despite the economic downturn.

CITIC-Prudential has achieved a strong competitive advantage through the introduction of innovative new products developed after the insurance product pricing reforms. During the year, the number of agents reached a historical high thanks to the changes of agent licensing exam requirements. With the development of the Internet Plus action plan, Internet technology is being used increasingly for wealth management and business support functions. In addition, the company has strengthened its investment function by building up its investment team, improving investment management, streamlining the investment process, enhancing investment performance, developing more investment channels and improving capital usage. In 2015, CITIC-Prudential’s total assets, revenue and net profit achieved double-digit growth.

In compliance with China’s new C-ROSS solvency system, CITIC-Prudential set up a new enterprise risk management system during the year, based on efficient corporate governance and guided by risk appetite to target a balance between risk and efficiency. The company also undertook a comprehensive review of its risk management policies and processes, structure and risk appetite formation.

Products

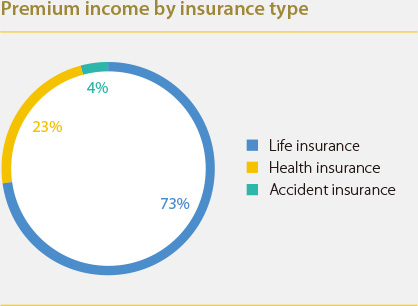

In 2015, CITIC-Prudential continued to focus on life insurance and health insurance as its core businesses, along with asset management and accident insurance, and pursued a business structure transformation and value upgrade. Premium income in 2015 was RMB6.2 billion, representing an increase of 22% from 2014. Premium income from life insurance was RMB4.5 billion, representing an increase of 14% from last year. Premium income from health insurance was RMB1.4 billion, representing an increase of 54% from last year.

During the year, CITIC-Prudential focused on high-value businesses and expansion as well as enhancements of the product mix in order to achieve growth. By strengthening the sales of key long-term protection products in the agency channel, CITIC-Prudential enjoyed sales growth in terms of quantity and quality. With the restructuring of the bancassurance channel to deal with volatility in the economic and investment environment, the company was able to reduce high cash value, short-term universal life insurance products and increase the proportion of regular premium products. Meanwhile, it decreased its new business strain, improved capital utilization and strengthened the management of business value. To address the needs of high net worth customers who wish to pass on their wealth to the next generation, CITIC-Prudential along with CITIC Trust continued to lead the industry with new trust services.

Insurance sales channels

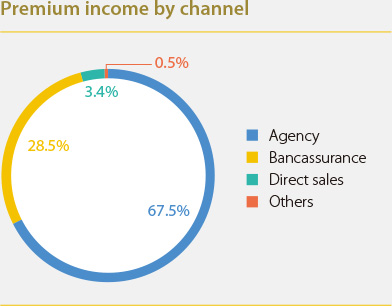

Individual insurance agents and bancassurance are the two major sales channels of CITIC-Prudential. In 2015, CITIC- Prudential began reforming its sales agent system and substantially increased the number of its sales staff to 21,957. Insurance premium income generated via individual insurance agents accounted for 68% of total insurance premium income, a 1.5 percent increase compared with last year. In addition, the Bancassurance department strengthened its cooperation with banks and developed an e-bank business as well as other value-added services. The management of e-commerce channels was also upgraded to comply with regulatory requirements and an online/internet sales management team was formed. Following these developments, an electronic service mechanism comprising E-CITIC-PRU and phase I of the new i-CITIC-PRU online platform was launched.