Financial Risk

Governance structure

As a sub-committee of the Executive Committee, the Asset and Liability Management Committee (“ALCO”) has been established to monitor financial risks of the Group in accordance with the relevant treasury and financial risk management policies (“management policies”). Relevant departments of CITIC Limited are responsible for communicating and implementing the decisions of ALCO, monitoring the adherence of the management policies and preparing relevant reports. All member companies have the responsibility for identifying and effectively managing their financial risk positions and reporting to the corresponding departments of CITIC Limited on a timely basis, in accordance with the overall risk framework under the management policies and within the scope of authorisation.

Based on the annual budget, ALCO shall review CITIC Limited’s financing plan and instruments, oversee fund management and cash flow positions, and manage risks relating to counterparties, interest rates, currencies, commodities, commitments and contingent liabilities, and is responsible for formulating hedging policy and approving the use of new risk management tools.

Asset and liability management

One of the main functions of ALCO is asset and liability management. CITIC Limited’s sources of funds for different businesses include long-term and short-term debt and equity, of which ordinary shares, preferred shares and perpetual securities are the alternative forms of equity financing instruments. CITIC Limited manages its capital structure to finance its overall operations and growth by using different sources of funds. The type of funding is targeted to match the characteristics of our underlying business.

1. Debt

ALCO centrally manages and regularly monitors the existing and projected debt levels of CITIC Limited and its major non-financial subsidiaries to ensure that the Group’s debt size, structure and cost are at reasonable levels.

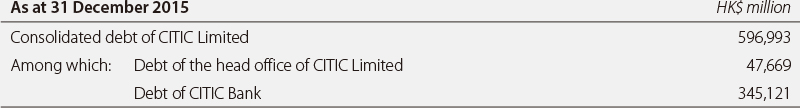

As at 31 December 2015, consolidated debt of CITIC Limited (1) was HK$596,993 million, including loans of HK$147,221 million and debt instruments issued (2) of HK$449,772 million. Debt of the head office of CITIC Limited (3) accounted for HK$47,669 million and debt of CITIC Bank(4) HK$345,121 million. In addition, the head office of CITIC Limited had cash and deposits of HK$10,869 million and available committed facilities from banks and subsidiaries of HK$21,255 million.

The details of debt are as follows:

- Note:

- (1) Consolidated debt of CITIC Limited is the sum of “bank and other loans” and “debt instruments issued” in the Consolidated Balance Sheet of CITIC Limited;

- (2) Debt instruments issued include corporate bonds, notes, subordinated bonds, certificates of deposit and certificates of interbank deposit issued;

- (3) Debt of the head office of CITIC Limited is the sum of “bank and other loans”, “long-term borrowings” and “debt instruments issued” in the Balance Sheet of CITIC Limited;

- (4) Debt of CITIC Bank refers to CITIC Bank’s consolidated debt certificates issued, including debt securities, subordinated bonds, certificates of deposit and certificates of interbank deposit issued.

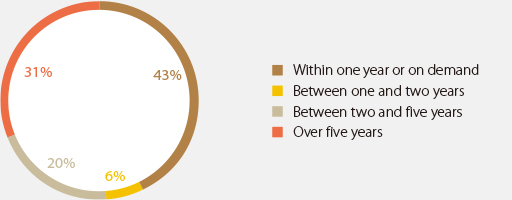

Consolidated debt by maturity as at 31 December 2015

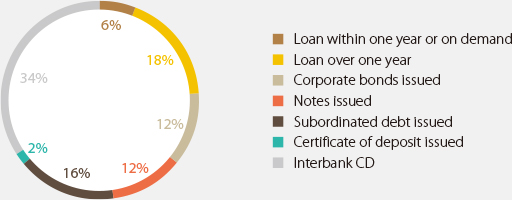

Consolidated debt by type as at 31 December 2015

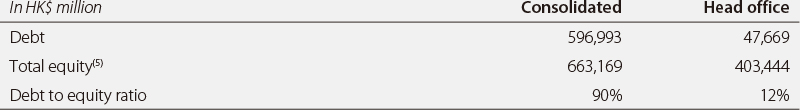

The debt to equity ratio of CITIC Limited as at 31 December 2015 is as follows:

- Note:

- (5) Total consolidated equity is based on the “total equity” in the Consolidated Balance Sheet; Total equity of head office is based on the “total ordinary shareholders’ funds and perpetual capital securities” in the Balance Sheet.

2. Liquidity risk management

The objective of liquidity risk management is to ensure that CITIC Limited always has sufficient cash to repay its maturing debt, perform other payment obligations and meet other funding requirements for normal business development.

CITIC Limited’s liquidity management involves the regular cash flow forecast for the next three years and the consideration of its liquid assets level and new financings necessary to meet future cash flow requirements.

CITIC Limited centrally manages its own liquidity and that of its major non-financial subsidiaries and improves the efficiency of fund utilisation. With flexible access to domestic and overseas markets, CITIC Limited seeks to diversify sources of funding through different financing instruments, in order to raise low-cost funding of medium and long terms, maintain a mix of staggered maturities and minimise refinancing risk.

Details of liquidity risk management are set out in Note 47(b) to the consolidated financial statements.

3. Contingent liabilities and commitments

Details of contingent liabilities and commitments of CITIC limited as at 31 December 2015 are set out in Note 46 to the consolidated financial statements.

4. Pledged loan

Details of cash and bank deposits, inventories and fixed assets pledged as security for CITIC Limited’s loan as at 31 December 2015 are set out in 41(d) to the consolidated financial statements.

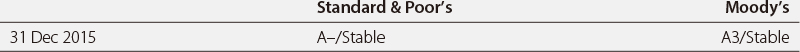

5. Credit ratings

On 2 March 2016, Moody’s changed CITIC Limited’s rating outlook from stable to negative following its decision to change China’s sovereign rating outlook to negative.