CITIC Bank

CITIC Bank is a fast-growing commercial bank engaged in the corporate banking, retail banking and financial markets businesses.

Year in review

The ongoing slowdown in the Chinese economy, internationalisation of the RMB and liberalisation of interest rates continued to strain the banking sector in 2015. At the same time, competition within the industry intensified further with the increase in financial disintermediation.

Despite these macro challenges, CITIC Bank focused on unlocking opportunities in peer competition through innovation. The bank recorded revenue of RMB145.5 billion in 2015, an increase of 17% over last year. Although there was a larger increase in the impairment for non-performing loans, the net profit attributable to shareholders continued to maintain a stable growth and reached RMB41.2 billion for the year.

To position itself for capturing future opportunities, CITIC Bank launched a major new initiative in 2015 that has the potential to drive growth for years to come. Together with several other CITIC companies, it will provide more than RMB700 billion in investment and financing to infrastructure and other projects related to China’s One Belt One Road initiative. The bank thus set up strategic relationships with many local governments. During the year, CITIC Bank continued to strengthen its support for the integration of Beijing, Tianjin and Hebei. The bank also established a branch in the Shanghai Pilot Free Trade Zone.

The greater rewards inherent in large opportunities such as these also bear increased risks. Over the year, CITIC Bank expanded the range and depth of its risk management protocols and started reforms to increase the independence of the audit process.

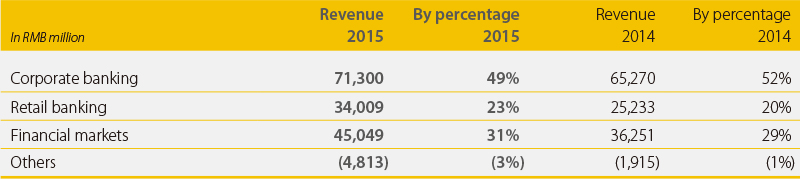

Operating income by segment

Corporate banking

A core business of CITIC Bank, corporate banking contributed almost half of all top line growth in 2015. As at the end of 2015, CITIC Bank ranked first among mid-sized commercial banks in China in terms of both overall scale and incremental corporate deposits.

New products launched in 2015 focused on innovative online and cross-border offers. The bank rolled out an enhanced suite of online cash management services for its B2B customers and also further developed its platform for cross-border cash pooling services. Cash-pooling will become increasingly important for corporate banking clients in the years to come as more and more Chinese multinationals seek to centralise their international treasury operations in RMB.

Retail banking

In 2015, the retail banking arm focused primarily on increasing distribution partnerships, expanding mobile payment services and creating a new Internet + Finance business model. New payment services in collaboration with companies as S.F. Express, JD.com and Xiaomi have already contributed to considerable growth in its base of credit card customers. Another new service, Quick Pass, enabled customers to clear payments on mobile phones linked to their CITIC Bank accounts.

In order to develop its Internet + Finance business, the bank launched a significant new initiative — Baixin Bank — in partnership with Internet giant Baidu in 2015, which is under approval of relevant authorities. Through this partnership, CITIC Bank has also secured a strategic new advantage in converting new customers as a result of its access to Baidu’s extensive database of hundreds of millions of mobile and online users.

Over the last few years, CITIC Bank has been focused on developing its branch network, working in particular last year to standardise quality of service and the customer experience. In 2015, the bank built on these foundations by rolling out a new training team tasked with smoothening branch operations and ensuring alignment with its broader branding and marketing efforts. CITIC Bank expects the initiative to contribute to higher sales, as well as facilitate improvements across its branch management.

In 2015, the number of retail customers in China increased by 16%. CITIC Bank opened 123 new outlets during the year, expanding its network to a total of 1,353 branches across the country.

Financial markets

CITIC Bank’s financial markets business is focused on monetary, capital and international financial markets. Principal products traded include foreign currencies, bonds, precious metals and equity derivatives. Services include bond market-making and underwriting, structured finance, international trade finance, as well as a range of other specialised investment and financing offers.

The financial markets arm of CITIC Bank was the number one firm in China’s mid-sized segment in 2015 across a number of areas: total size of credit bonds issued in the interbank market, total volume of foreign exchange spot trading and cross-border RMB settlement.