Group Financial Results

Revenue

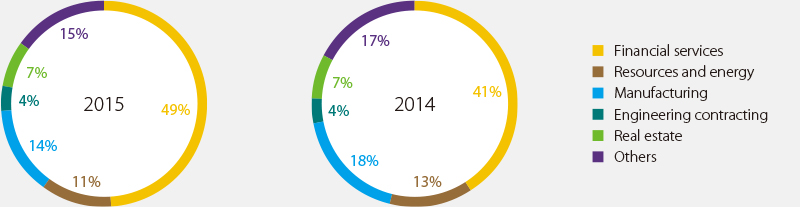

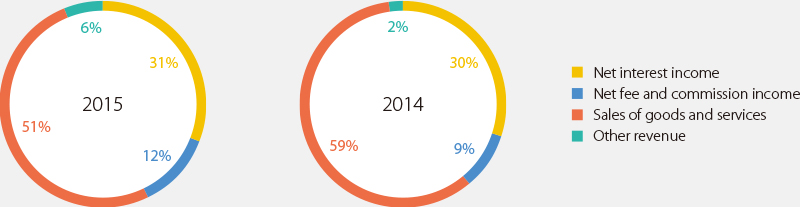

In 2015, CITIC Limited recorded revenue of HK$416,813 million, an increase of HK$14,689 million or 4%, as compared with 2014. Revenue from the financial services increased by HK$40,529 million, largely due to the gains from the disposal of a 3.16% equity interest and placing of new shares of CITIC Securities, amounting to HK$10,205 million and HK$2,004 million, respectively. Along with an increase in net interest income from banking business driven by an increase in scale of interest-bearing assets, net non-interest revenue was growth as well, which was driven by rapid growth of bank handling charges from credit card, agency and wealth management services. The manufacturing business of the Group recorded a decrease in revenue of HK$11,768 million, or 16% as a result of the fall in revenue from the special steel and heavy industries businesses owning to weaker market demand. This was partially compensated by the greater volume of aluminium wheels sold. Revenue from engineering contracting segment was HK$2,451 million, or 14% less than the previous year, mainly due to the decrease in the number of projects undertaken. The Group’s revenue was also impacted by a HK$6,122 million fall in revenue in the resources and energy business, down by 12% year-on-year, a reflection of the declining demand for commodities such as crude oil. As a result of a decrease in bookings of completed properties, revenue from the real estate segment decreased by HK$2,381 million or 8%.

| Increase/(decrease) | ||||

|---|---|---|---|---|

| In HK$ million | 2015 |

2014 (restated) |

Amount |

% |

| Financial services | 205,378 | 164,849 | 40,529 | 25% |

| Resources and energy | 45,664 | 51,786 | (6,122) | (12%) |

| Manufacturing | 60,077 | 71,845 | (11,768) | (16%) |

| Engineering contracting | 14,676 | 17,127 | (2,451) | (14%) |

| Real estate | 27,528 | 29,909 | (2,381) | (8%) |

| Others | 63,348 | 66,216 | (2,868) | (4%) |

By nature

| Increase/(decrease) | ||||

|---|---|---|---|---|

| In HK$ million | 2015 |

2014 (restated) |

Amount |

% |

| Net interest income | 131,883 | 121,078 | 10,805 | 9% |

| Net fee and commission income | 48,899 | 37,620 | 11,279 | 30% |

| Sales of goods and services | 211,383 | 237,189 | (25,806) | (11%) |

| – Sales of goods | 171,247 | 196,652 | (25,405) | (13%) |

| – Services rendered to customers | 27,254 | 25,796 | 1,458 | 6% |

| – Revenue from construction contracts | 12,882 | 14,741 | (1,859) | (13%) |

| Other revenue | 24,648 | 6,237 | 18,411 | 295% |

Impairment losses

In 2015, the Group recorded an asset impairment of HK$79,004 million, an increase of HK$23,984 million, 44% from 2014. Of the total impairment, CITIC Bank accounted for HK$49,863 million, an increase of HK$19,986 million, or 67% from 2014, which mainly includes HK$43,739 million impairment on its loans and advances to customers. The other major impairment loss of HK$17,807 million, was related to the Sino Iron Project in Australia, primarily as a result of a decrease in the forecast iron ore price.

Net finance charges

Finance costs in 2015 was almost equal to the previous year, which amounted to HK$11,024 million, as a result of an decrease in borrowings both at operation management and subsidiaries in the non-financial segments, as well as a lower average cost of debt during the year.

Finance income from operation management and subsidiaries in the non-financial segments amounted to HK$2,794 million, an increase of 24% from 2014. This increase mainly came from interest income on bank deposits.

Interest expense capitalised

In 2015, interest expense capitalised was mainly attributable to the Sino Iron Project and real estate projects. Capitalised interest expense decreased from HK$5,874 million in 2014 to HK$5,597 million in 2015.

Income tax

Income tax of the Group in 2015 was HK$20,613 million, a increase of HK$2,613 million compared with 2014. This was in line with the increase in profit before taxation.