CITIC Trust

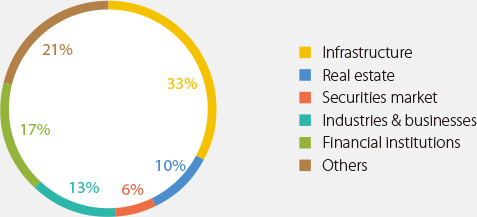

CITIC Trust is the largest trust company in China with total assets under management (AUM) of over RMB1,386.2 billion at the end of 2015, a growth of 25% since 2014. For nine consecutive years, it has been the country’s largest trust provider in terms of total AUM. The company also manages a proprietary trading and investing for its own funds.

The company has maintained its leading position because of the comprehensive range of integrated solutions it offers across investment, financing and wealth management services. Clients are primarily institutional investors and wealthy individuals.

CITIC Trust has pioneered a number of unique financial products and services, and it continues to innovate a wide array of financial solutions leveraging diverse financial instruments such as securities, private equity funds, asset securitisation and mezzanine funds, as well as debt financing and trustee services.

Year in review

With competition becoming increasingly fierce in the trust sector, CITIC Trust continued to position itself for long-term growth and stability in 2015. Over the year, the company launched several new specialised products and services. Continuing to pioneer the development of the trust sector, it rolled out a new product specifically targeting the growing range of public-private partnership (PPP) opportunities and formed strategic partnerships with large corporations such as Evergrande Group and Wanda Group. The company will work closely with these clients to develop a full range of tailored financial solutions, and in the future CITIC Trust aims to expand upon this model and build similar relationships with corporate clients.

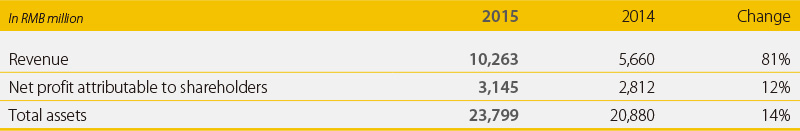

Organic growth in business remained strong all year, contributing to revenue of RMB10.3 billion in 2015. Net profit attributable to shareholders amounted to RMB3.1 billion, while the attributable trust profit paid to beneficiaries was over RMB54.3 billion.

The company’s net capital adequacy ratio remained stable at 231% at the end of 2015. Net capital of the company was RMB12.9 billion, while the balance of risk capital was RMB5.6 billion.

Given the growing breadth of financial products and services and diverse assets to which trust vehicles are exposed, CITIC Trust put a priority on improving its risk management system during the year. With an expanded array of risk assessment tools and internal audit processes, CITIC Trust now has a larger integrated range of internal compliance measures in place with controls over capital allocation.

Products

For trust companies in China, the ability to stay ahead of industry trends and roll out new products is the most critical factor for continued growth. In 2015, CITIC Trust developed several industry-leading products and services:

- PPP Trust Schemes: the Chinese government has increasingly promoted the PPP model to raise capital for the growing number of new infrastructure projects across the country. Targeting this emerging investment opportunity, CITIC Trust has established PPP trust schemes with local government in Tangshan. The PPP trust is built to leverage CITIC Trust’s extensive financial network as a platform to source capital. The RMB600 million trust in Tangshan became the country’s first.

- Asset Securitisation: leveraging the growing list of asset classes approved by the Chinese government for securitisation in 2015, CITIC Trust successfully completed the country’s first corporate asset securitisation backed by commercial property rental income as the underlying asset.

- Consumer Trust Products: providing financing for a diverse range of projects, these products make use of customised online platforms to connect investors and manufacturers as well as raise capital from ordinary consumers who, depending upon the project, participate in group buying or crowdfunding schemes. With significantly lower barriers to subscription than conventional trust products, consumption trusts open investment opportunities to a greater variety of investors. The flexible structure also allows these investors to divest their stakes in return for consumption rights on the relevant goods. CITIC Trust has set up eight consumption trust products by the end of 2015 across pensions, the diamond trade and tourism services.

- Family Trust Services: launched in 2014, family trust services continued to grow steadily throughout the year. Expanding the product line beyond family office trust plans, the company delivered increasingly specialised investment, insurance trust services and other wealth management services to its clients. This business promises to become one of the company’s most sustainable long-term sources of revenue.