CITIC Bank

CITIC Bank is a joint-stock commercial bank in China engaged in corporate banking, retail banking and financial markets services.

Year in review

As the deleveraging of China’s economy continued and financial regulations tightened, the growth rate of Chinese banks’ balance sheets slowed progressively in 2017 and the sector was lack of growth drivers. Despite these headwinds, the overall performance of CITIC Bank remained stable.

For the year 2017, revenue was RMB157.2 billion, representing a year-on-year increase of 2%. Net interest income dropped 6% due primarily to the compression of the low yield interbank business and higher funding interest rates. However, net interest margin widened as the bank better managed its loan pricing and optimised deposit structures. Non-interest income similarly sustained positive momentum to contribute 37% of revenue, compared with 31% in 2016. After an increased impairment charge for asset loss, profit attributable to ordinary shareholders increased slightly by 2% to RMB42.6 billion.

Asset and liability management

CITIC Bank maintained its strategy of light transformation while continuing to reduce its balance sheet and optimise its structure over the year. Total assets and total liabilities decreased, respectively, by 4% and 5%. On the asset side, the bank proactively reduced the scale of its interbank business and allocated more resources to its traditional credit business to better support the real economy. The bank also accelerated the pace of asset transfers in order to release liquidity and better balance risk with return, as well as growing its light-capital and high-return product lines such as credit cards and personal loans. Over the year, total loans increased by 11%, including a 29% expansion in personal loans. Total deposits, meanwhile, fell by 6% owing to the higher funding costs that resulted from increased competition.

Risk management

As of the end of 2017, overall asset quality remained manageable as the bank continued to adopt measures such as cash collection and non-performing asset disposals. The NPL ratio fell 1bp to 1.68%, and the allowance coverage ratio increased by 13.9 percentage points to 169.4%.

Business highlights

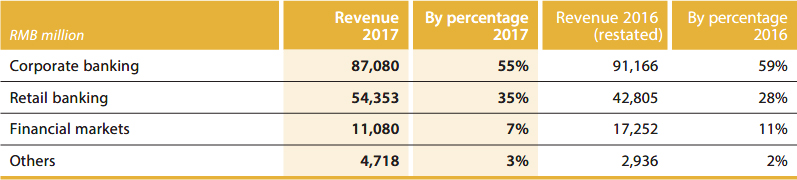

In 2017, the retail banking business continued to grow rapidly. Its revenue reached RMB54.4 billion, and the overall contribution increased by 7 percentage points to 35% over the year. The structure of corporate banking business was continued to be adjusted while its revenue declined 4% to RMB87.1 billion. Revenue contribution from financial markets services dropped by 4 percentage points to 7%, mainly due to the shrinking interbank business.

Corporate banking: The bank continued to put the focus on high quality customer and serve the real economies. Corporate deposits dropped by 7%, while the deposit cost declined by 8bps to 1.62%, primarily because the bank continued to optimise the deposit mix by increasing lowcost settlement deposits and compressing highcost bank acceptances and negotiated deposits. Transaction banking, investment banking, asset custody and international business all performed satisfactorily during the year. Key developments for the year included the launch of the Eco-finance Cloud platform for transaction banking, which recorded turnover of RMB69.6 trillion, a growth of 5% year-on-year. The asset custody business grew by 23% year-on-year, while mutual fund custody assets reached RMB2.1 trillion, the first in the Chinese banking sector to reach this level. What’s more, the bank continued to strengthen its core competency in debt financing and retained its market-leading position in terms of total financing scale. In addition to this, the bank maintained the largest market share among all joint-stock banks(1) in international payments.

Note:

(1) Including China CITIC Bank, China Merchants Bank, China Minsheng Bank, Industrial Bank, Shanghai Pudong Development Bank, China Everbright Bank, Huaxia Bank, Ping’an Bank, Guangdong Development Bank, China Zheshang Bank, China Bohai Bank and Evergrowing Bank.

Retail banking: The retail customer base continued to improve over the year, particularly among medium- to high-end customers. As of the end of 2017, the total number of retail customers increased by 19% to 80.05 million. Priority products for the year were private banking, credit cards and personal loans. Private banking AUM exceeded RMB402.5 billion, up 25%, while the customer base for this business grew by 31% to reach 28,000. In the credit card business, the total number of cards surpassed 49.57 million, and the balance of credit card loans reached RMB333.7 billion, up 40%, contributing to a total revenue increase of 56% to RMB39.1 billion. In personal loans, this business continued to develop steadily, as a result of its new focus on products such as collateral loans backed by property, unsecured loans, pledged loans backed by financial assets and personal supply chain financing.

Financial markets: The bank reduced the scale of its interbank business during the year and accelerated asset securitisation over the year. It also continued to optimise channels and platforms to make the interbank business lighter in terms of capital, assets and costs. One example was the key online platform “CITIC Interbank+”, which was set up to provide financial institutions with integrated interbank services, including wealth management, trading, agent services and clearing. The number of users on the platform reached 817, and total turnover grew to RMB1288.3 billion. Additionally, other businesses such as forex market-making trading, bond trading, debt securities & interest rate derivatives experienced double-digit trading volume growth. CITIC Bank was also included in the first group of market makers joining Bond Connect.

Fintech

CITIC Bank will continue to apply the latest Fintech to financial services, speed up digital channel building, strengthen online payment and crossover cooperation with tech companies. The bank also strives to improve its competitiveness by exploring new business models and procedures. In 2017, the bank launched its mobile banking 4.0 to improve the customer experience and service capabilities. The number of mobile banking users in 2017 reached 27.33 million, a year-on-year increase of 40%, while trading volume reached 128 million, up 36%. During the year, the bank became the first Chinese bank to launch a blockchain-based Letter of Credit System, which had achieved a trading turnover greater than RMB1 billion as at the end of 2017. In addition, three key online payment products — Quan Fu Tong, Cross-border E-commerce pay, and CITIC e-pay — continued to strengthen their leading market positions. Quan Fu Tong’s total turnover reached RMB1.2 trillion, up 131% over the year. Cross-border E-commerce pay was the first among its peers to cover the whole chain of cross-border payment on both the business side and customer side. Its turnover increased by 24% to RMB34.6 billion. CITIC e-pay launched new functions such as B2B interbank receivables to further satisfy demand for both C2B and B2B businesses. It recorded a year-on-year increase in turnover of 185% to RMB20.8 billion. Also during the year, CITIC aiBank, a bank set up between CITIC Bank and Baidu, officially opened in November 2017 as an online platform supporting small and frequent trading with payment, financing and asset management services.