CITIC Trust

CITIC Trust, the largest and most stable trust company in China, is mainly engaged in the trust, specialised subsidiary and proprietary businesses. CITIC Trust is rated as a Grade A trust company by the China Trustee Association.

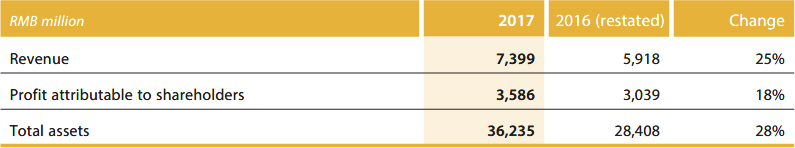

The key theme of China’s financial industry in 2017 was “strict regulation, risk prevention, coordination, deleveraging and measured opening-up.” In the trust sector, growth slowed accordingly. CITIC Trust, however, was able to maintain a robust operation, growing its revenue by 25% year-on-year to reach RMB7.4 billion. The increase was mainly attributable to the gain from fair value changes in the proprietary business. Net profit attributable to shareholders reached RMB3.6 billion, representing an increase of 18% over 2017. Total proprietary assets amounted to RMB36.2 billion, up 28% year-to-date.

Year in review

As of the end of 2017, total trust assets under management amounted to RMB1,986.7 billion, of which RMB303.2 billion of assets under management were within its specialised subsidiaries through limited partnerships, asset management vehicles and equity investment funds.

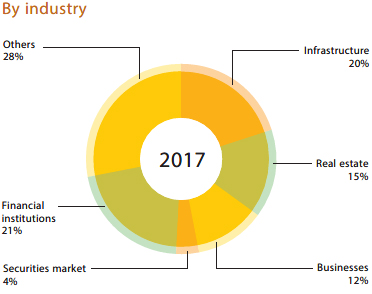

Over the year, 1,552 new trust projects began, representing RMB1,075.2 billion of AUM. During this period, the trust business remained stable and yielded RMB4.4 billion in revenue while distributing RMB73.2 billion in trust profit attributable to beneficiaries. The trust assets were allocated to infrastructure, real estate, healthcare and elderly care, culture and technology. Among its trust assets, 24% are actively managed and are mainly invested in securities, equity and financing assets; 76% are under non-active management(1).

Allocation of trust assets

Note:

(1) Category under non-active management refers to a trust scheme under which a trust company, acting as the trustee, provides the trustor (beneficiary) with administrative and executive services for specified purposes.

Trust products and services

CITIC Trust sticks to a fundamentals-first approach in its scope of services. Guided by the principles of risk management and sustainability, CITIC Trust has continued to innovate in its service offerings and optimise its product structure in line with market demand. By leveraging its integrated platform, it makes efficient capital and asset allocation to better serve the real economy in businesses spanning the financing, wealth management and trust service segments.

Financing: CITIC Trust delivers integrated financing solutions to clients, including governments, enterprises, financial institutions and other institutional investors.

As of the end of 2017, approximately RMB1.3 trillion in trust assets were invested in the real economy, facilitating the development of Belt and Road projects, infrastructure, livelihood projects and emerging industries. The trust assets allocated to infrastructure-related projects exceeded RMB380 billion. A total of RMB120 billion in trust assets were further invested in projects related to the coordinated development of the Beijing, Tianjin, and Hebei regions. CITIC Trust also fully supported the development of small- and medium-sized enterprises, including participation in a RMB40 billion national VC Fund for start-ups in emerging industries. Additionally, it launched an industrial fund in Guizhou Province to promote development-oriented poverty reduction projects. In another initiative during the year, CITIC Trust rolled out a trust fund in support of small- and medium-sized enterprises in Beijing and issued 670 loans totalling over RMB8.5 billion.

CITIC Trust continues to extend its PPP business. To date, it has invested nearly RMB100 billion in these types of projects, including infrastructure projects, public service projects in sectors such as healthcare and elderly care, energy conservation and environmental protection, education and logistics. Along with China 22MCC Group Corporation, CITIC Trust established a consortium and won the bid for an education PPP project at No.1 High School in Huaibei, Anhui province. This project fully utilises the consortium’s strengths in financing, construction and operation.

Wealth management: CITIC Trust provides diversified wealth management services for high net worth individuals and institutional clients, with a wide range of products across currency markets, fixed income and equity investments. These offerings are segmented into well-defined categories, such as family trust, insurance trust and tailored wealth management.

In the family trust business, CITIC Trust served close to 900 clients with total AUM of over RMB12 billion as of the end of 2017, maintaining its leading position in the industry. It provides clients with well-rounded integrated services from asset protection, education and pensions to tailor-made family office services. Outside China, CITIC Trust’s offshore subsidiary CTI Capital Global Opportunities Fund, the first overseas equity hedge fund issued by CTI Capital, won the Eurekahedge Best New Asian Hedge Fund award for 2017.

Trust service: Clients’ assets are typically held in trust structures, with CITIC Trust providing consulting and management services to resolve issues such as asset isolation and liquidity. Specific services include equity trust, consumer trust, asset securitisation, corporate annuity trust, custodial account management and charity trust.

CITIC Trust saw the total size of its asset securitisation business exceed RMB165 billion in 2017 for a fifth consecutive year of industry leadership. It also won the Excellent ABS Issuer award by China Government Securities Depository Trust & Clearing Co. Ltd. What’s more, CITIC Trust is leveraging its strengths in trust services and asset management to hold charity foundation assets in a trust structure, as well as strategically allocate its assets. Since China’s Charity Law took effect in 2016, CITIC Trust has established four charity trust projects. In July, it was assigned as the fiduciary on behalf of He Xiangjian Foundation, established by Midea Group’s founder, to set up an RMB500 million charity trust project — the largest in the trust industry to date.

Risk and capital

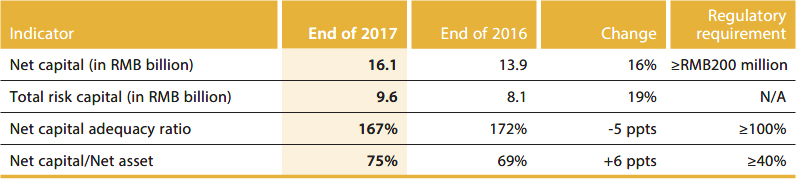

CITIC Trust balances growth with risk and maintains a solid capital base. It also recently strengthened its capital management, particularly for new business. As of the end of 2017, the net capital adequacy ratio remained solid at 167%, and the balance of net capital was RMB16.1 billion, both surpassing regulatory requirements. This capital provides a strong buffer to absorb losses and enable long-term growth and business innovation.