Overview

Profit attributable to ordinary shareholders

During 2017, the Group achieved net profit attributable to ordinary shareholders of HK$43,902 million, representing a corresponding increase of HK$756 million or 2% from 2016. It included gain from Guoan Football Club bringing new strategic investor, SINOPEC SSC and Digital Domain revaluation of approximate total HK$5,900 million, as well as impairment losses after tax of HK$7,184 million related to the Sino Iron Project.

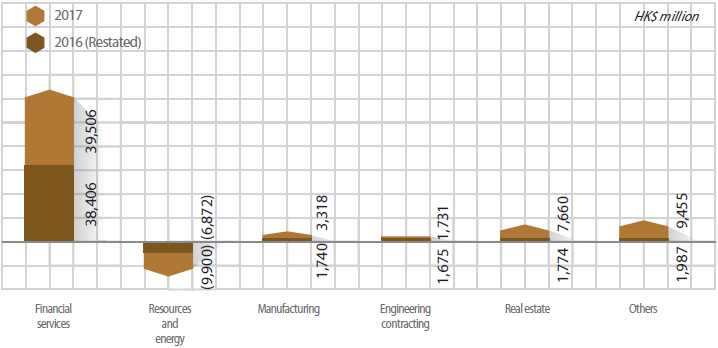

The financial services segment recorded net profit attributable to ordinary shareholders of HK$39,506 million, representing a corresponding increase of HK$1,100 million or 3% from 2016. Excluding the impact of translation due to depreciation of average exchange rate of RMB for the current period, the corresponding increase of net profit would have been 4%. Our banking business showed steady improvement in operating efficiency, with net profit attributable to the bank’s shareholders recording a year-on-year increase of 2%. However, being affected by the preferred share issuance of CITIC Bank and the above-mentioned exchange rate translation, net profit of CITIC Bank attributable to the Group decreased by 1% as compared to the previous year. Our trust business further optimized its business structure and recorded a steady growth in net profit, maintaining its leading position in the industry. Healthy and sustainable growth of Insurance business along with continuous optimization of business structure is the main contribution to the 50% increase of its net profit. The businesses under CITIC Securities continued to maintain leading position in its market, with net profit increasing by 10% over the previous year.

For the non-financial segments, as the real estate business has achieved significant results in structure adjustment and optimization, its continued operations reported net profit attributable to ordinary shareholders of HK$7,660 million in 2017, increasing substantially by 332% as compared with the previous year. Such increase was mainly due to the share of net equity profit from China Overseas Land & Investment Ltd. (hereafter referred to “China Overseas”) and the Lujiazui Project of Shanghai Ruibo Real Property Co., Ltd of approximately HK$6,676 million in aggregate for the current period. For manufacturing business, it has benefited from the increases of gross profit per tonne of steel and sales volume of steel in special steel business, the steady sale growth of aluminium wheels, the performance upturn of heavy equipment business and the rapid growth of robots and intelligent equipment business and reported net profit attributable to ordinary shareholders of HK$3,318 million, representing a corresponding increase of 91%. Our engineering contracting business remain steady, with net profit attributable to ordinary shareholders recording a corresponding increase of 3% to HK$1,731 million. Our resources and energy business recorded net loss attributable to ordinary shareholders of HK$9,900 million. In particular, Sino Iron Project has achieved a continuous decrease in the unit operating cost per ton in 2017, which was due to the increase in the production volume of iron ore. However, following the commencement of commercial production in July 2016, the related costs were charged to profit or loss and this resulted in an increase in the operating loss as compared to 2016. There was also an impairment of approximately HK$7,184 million recorded this year.

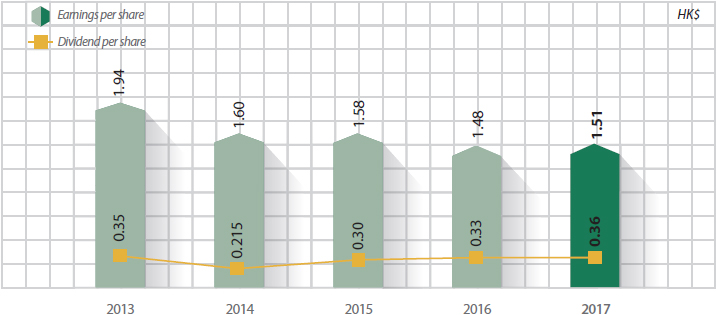

Earnings per share and dividends

Earnings per share of profit attributable to ordinary shareholders was HK$1.51 in 2017, an increase of 2% from HK$1.48 in 2016. As at 31 December 2017, the number of ordinary shares outstanding was 29,090,262,630.

At the forthcoming annual general meeting, the Board will recommend a final dividend of HK$0.25 per share to ordinary shareholders. Together with the interim dividend of HK$0.11 per share paid in September 2017, the total ordinary dividend will be HK$0.36 (2016: HK$0.33 per share). This equates to an aggregate cash distribution of HK$10,473 million.

Profit/(loss) and assets by business

| Profit/(loss) For the year ended 31 December |

Assets as at 31 December | |||

|---|---|---|---|---|

| HK$ million | 2017 | 2016 (Restated) | 2017 | 2016 (Restated) |

| Financial services | 57,579 | 55,498 | 6,925,076 | 6,729,902 |

| Resources and energy | (9,484) | (6,465) | 129,438 | 137,337 |

| Manufacturing | 3,524 | 1,310 | 130,381 | 96,112 |

| Engineering contracting | 1,729 | 1,673 | 46,127 | 36,796 |

| Real estate | 7,941 | 2,264 | 159,664 | 143,596 |

| Others | 11,045 | 3,218 | 163,835 | 113,090 |

| Total | 72,334 | 57,498 | 7,554,521 | 7,256,833 |

| Operation management | (7,286) | (4,698) | ||

| Discontinued operations | - | 10,309 | ||

| Elimination | 48 | (413) | ||

| Profit attributable to noncontrolling interests and holders of perpetual capital securities |

21,194 | 19,550 | ||

| Profit attributable to ordinary shareholders | 43,902 | 43,146 | ||

Profit/(loss) attributable to ordinary shareholders from continuing operations by business

Financial services:

In 2017, the financial services segment recorded net profit attributable to ordinary shareholders of HK$39,506 million, increasing by 3% over the previous year. Excluding the impact of translation due to depreciation of average exchange rate of RMB for the current period, the corresponding increase of net profit would have been 4%.

CITIC Bank’s banking business remained the principal source of profit for the financial services segment. As more tightened monetary market and stringent regulatory policy, CITIC Bank proactively took initiatives to shrink balance sheet and further optimized its income structure. As a result, the proportion of its non-interest income continued to increase by 6 percentage points to 37%, while the contribution of its retail business increased obviously with the proportion increasing from 28% to 35%. Meanwhile, CITIC Bank continued to reinforced loan pricing management and optimized deposits structure, and its net interest margin has gradually stabilized and recovered. CITIC Trust’s trust business maintained steady growth, and it ranks one of top in respect of total assets under management, revenue and trust fee income and net profit for ten consecutive years. The businesses under CITIC Securities continued to maintain leading position in its market, with net profit increasing by 10% over the previous year. The insurance business maintained a rapid yet healthy growth, continued to optimize product offerings and steadily improved the value of its bancassurance channel, thus recording a corresponding increase of 50% in profit.

Resources and energy:

In 2017, the accelerated global economy recovery provided support to demand increase of international commodity and energy, and also laid a good foundation to the development of the resources and energy business. The trading businesses of coal, iron ore, ferroniobium and others grew rapidly, however, the increased coal price imposed adverse impact on the Group’s power generation business.

The resources and energy business recorded a loss of HK$9,900 million in 2017, representing as year-on-year increase in loss of HK$3,028 million. In particular, crude oil business saw a significantly improved operating result for the year, primarily the result of a higher average crude oil realized price and the implementation of ongoing cost control measures. The power generation continued to provide steady cash flow. The Las Bambas copper mine project in Peru, which is 15% owned by CITIC Metal Group and put into commercial production in July 2016, has contributed net profit of HK$617 million to the Group.

2017 is the first full year of commercial operation for the Sino Iron project, of which approximately 17 million wet metric tonnes of iron ore concentrate have been exported. The net loss increased as compared to 2016 was mainly due to the commencement of commercial operation in July 2016, of which the related costs were charged to profit or loss. As at 31 December 2017, an impairment assessment on the Sino Iron Project was carried out and accordingly an impairment of approximately HK$7,184 million was made.

Manufacturing:

The manufacturing business recorded net profit attributable to ordinary shareholders of HK$3,318 million in 2017, representing a substantial increase of HK$1,578 million or 91% from 2016. The steel market indicated positive prospect, CITIC Pacific Special Steel completed the acquisition of Qingdao Special Steel during the year and the sale of our special steel business increased year-on-year by 25%. Benefited from the continued optimization of product structural and effective measures to reduce raw material purchase cost, the gross profit of steel product kept increasing and the net profit increased 9% from the previous year. Driven by the modest growth of domestic auto industry and the steady growth in demand from American and European markets, aluminium wheels and castings business maintained rapid growth with the net profit of CITIC Dicastal increasing by 17% from the previous year. CITIC Heavy Industries turned from loss to profit in 2017, because it has implemented the new business model of acting as “a core manufacturing +integrated service provider”, improved its overall market competitiveness, achieved performance upturn in heavy equipment business and rapid growth in robots and intelligent manufacturing business through devoting more efforts in product development and marketing.

Engineering contracting:

The engineering contracting business recorded net profit attributable to ordinary shareholders of HK$1,731 million in 2017, representing an increase of 3% from 2016. Affected by the decreases of gross profit margin in new projects, the net profit of CITIC Construction stayed flat over the previous year. As PPP projects such as the Clean Water Project in Wuhan City and the Forest Avenue are progressing smoothly, CITIC Engineering Design increased significantly by 87%.

Real Estate:

The real estate business recorded net profit attributable to ordinary shareholders of HK$7,660 million in 2017, representing a substantial increase of 332% from 2016. It was because the net equity profit arising from China Overseas and the Lujiazui Project of Shanghai Ruibo Real Property Co., Ltd of approximately HK$6,676 million in aggregate for the current period and the relevant tax expenses and other costs incurred from real estate business reorganization during the same period last year.

The occupancy rate for investment properties was approximately 95% as at 31 December 2017, which was comparable with preceding years.

Others:

The net profit attributable to ordinary shareholders in 2017 increased significantly by HK$7,468 million or 376% to HK$9,455 million. It included gain from Guoan Football Club bringing new strategic investor, SINOPEC SSC and Digital Domain revaluation of approximate total HK$5,900 million. In addition, the net profit was primarily attributed from infrastructure business such as tunnels and expressways, international telecommunications service business, Dah Chong Hong, environment business, publication services and others.

The profit contribution from the infrastructure business, including tunnels and expressways, recorded a slight decrease due to the 30 years franchise period of the Eastern Harbour Crossing ended in August 2016 and transferred the tunnel to the Hong Kong government. Profit attributable to equity shareholders of CITIC Telecom International has a year-on-year increase of 4% when compared with 2016. Dah Chong Hong recorded 57% increase in net profit over the previous year as a result of the rapid business growth in Mainland auto industry. Environment business of CITIC Envirotech also recorded continued profit growth 16%, which is benefited from the water treatment business and the increase of the number of EPC projects. The increases of publication business, knowledge information service and educational training drove the net profit of CITIC Press increased rapidly by 62% and thereby maintained its leading position in the book market of business, management and social sciences.