Board Committees

The board has appointed a number of committees to discharge the board functions. Sufficient resources are provided to enable the board committees to undertake their specific roles. The respective role, responsibilities and activities of each board committee are set out below:

Audit and risk management committee

The audit and risk management committee oversees the relationship with the external auditor, and reviews the Company’s financial reporting, annual audit and interim report. The committee acts on behalf of the board in providing oversight of the Company’s financial reporting system, risk management and internal control systems, reviews and monitors the effectiveness of the internal audit function, and reviews the Company’s policies and practices on corporate governance. The committee currently consists of two non-executive directors and three independent non-executive directors. The chairman of the committee is Mr Francis Siu Wai Keung, an independent non-executive director. Mr Francis Siu Wai Keung has the relevant professional qualification and expertise in financial reporting matters. The audit and risk management committee holds four regular meetings each year (at least two of which are with the Company’s external auditor). At invitation of the audit and risk management committee, other directors, senior management and other relevant persons, as well as experts or consultants with relevant experience or expertise may also attend the meetings. The audit and risk management committee members also meet in separate private sessions with the external and internal auditors without the presence of executive directors and management at least once a year.

Duties of the audit and risk management committee

The authority, role and responsibilities of the audit and risk management committee are set out in written terms of reference. The committee reviews its terms of reference at least once a year to ensure they remain in line with the requirements of the CG Code. Amendments to the terms of reference are submitted to the board for approval. The terms of reference are available on the Company’s website and the Hong Kong Stock Exchange’s website.

Under its terms of reference, the audit and risk management committee shall

- review and monitor the integrity of the Company’s financial information and provide oversight of the financial reporting system;

- monitor the effectiveness of external audit and oversee the appointment, remuneration and terms of engagement of the Company’s external auditor, as well as its independence;

- oversee the Company’s internal audit, risk management and internal control systems, including the resources for the Company’s internal audit, risk management, accounting and financial reporting functions, staff qualifications and experience, as well as arrangements for concerns raised by staff on financial reporting, internal control and other matters (“whistle-blowing”);

- undertake corporate governance functions delegated from the board, including

- (a) reviewing the Company ’s policies and practices on corporate governance and making recommendations to the board as well as the Company’s compliance with the CG Code and disclosure in the corporate governance report;

- (b) reviewing and monitoring

- (i) the training and continuous professional development of directors and senior management;

- (ii) the Company’s policies and practices on compliance with legal and regulatory requirements;

- (iii) the code of conduct and compliance manual (if any) applicable to employees and directors; and

- (iv) the Company’s whistle-blowing policy and system.

- undertake other authorities delegated by the board.

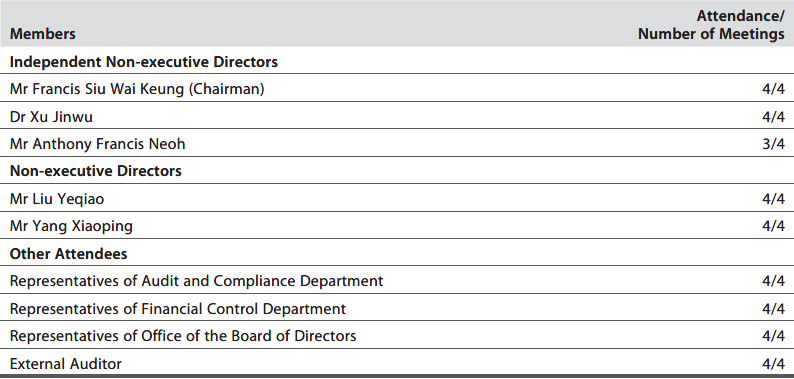

Committee composition and meeting attendance

The composition of the audit and risk management committee during the year under review as well as the meeting attendance of the committee members are as follows:

Membership and Attendance

The joint company secretary, Mr Choy Wing Kay, Ricky acts as the secretary to the committee. The committee is supported by a working group which consists of representatives from Audit and Compliance Department, Financial Control Department, Office of the Board of Directors and other departments of the Company. The working group provides services to the committee to ensure that sufficient resources are made available for the committee to perform its duties. An agenda and committee papers are sent to the committee members at least three days prior to each regular meeting. The draft and final version of minutes are circulated to all committee members for their comments and records within a reasonable time after the meeting. Full minutes of the meetings are kept by the joint company secretary.

The chairman of the committee summarises the activities of the committee and issues arising and reports to the board after each audit and risk management committee meeting.

Work done in 2017

The audit and risk management committee performed the followings in 2017:

At the meeting held on 26 March 2018, the audit and risk management committee reviewed and approved the Company’s annual financial statements and annual report for the year ended 31 December 2017, and considered reports from the external and internal auditors. The audit and risk management committee recommended to the board for approval of the 2017 annual report.

Nomination committee

The nomination committee was established by the board with written terms of reference in compliance with the CG Code. The terms of reference are available on the Company’s website and the Hong Kong Stock Exchange’s website.

The nomination committee reports directly to the board and its primary functions are:

- to determine the policy for the nomination of directors and set out the nomination procedures and the process and criteria adopted to select and recommend candidates for directorship, which shall take into consideration the principle of diversity;

- to review the structure, size, composition and diversity of the board at least annually and make recommendations on any proposed changes to the board;

- to assess the independence of independent non-executive directors;

- to make recommendations to the board on the appointment or re-appointment of directors; and

- to review the board diversity policy and make recommendation on any required changes to the board.

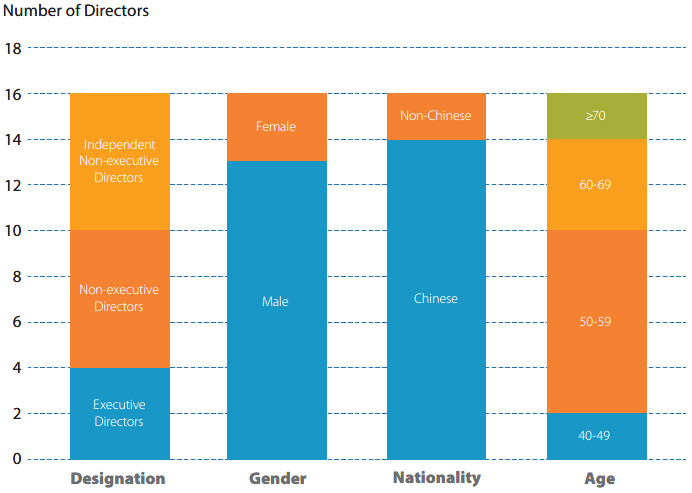

The board diversity policy sets out the approach to achieve diversity in the board, which includes and makes good use of the difference in skills, experience and background, geographical and industry experience, ethnicity, gender, knowledge and length of service and other qualities of the members of the board. These differences will be considered in determining the optimum composition of the board and all board appointments will be based on merit, having due regard to the overall effective functioning of the board as a whole. The Company believes that diversity can strengthen the performance of the board, promote effective decision-making and better corporate governance and monitoring. The nomination committee discusses and agrees annually the relevant measurable objectives that the board has set for implementing this policy and makes recommendation to the board for approval. It also monitors the implementation of this policy and reports to the board on the achievement of the measurable objectives for achieving diversity under this policy.

The following chart shows the diversity profile of the board as at 31 December 2017:

The nomination committee currently comprises two executive directors, one non-executive director and four independent non-executive directors, and is chaired by Mr Chang Zhenming, the chairman of the board. The committee meets at least annually and at such other times as it shall require. The joint company secretary, Mr Choy Wing Kay, Ricky acts as the secretary to the committee. The committee is provided with sufficient resources enabling it to perform its duties, and it can seek independent professional advice at the Company’s expense if necessary.

During the year under review, one nomination committee meeting was held and two sets of written resolutions were passed by all the committee members. The joint company secretary prepared full minutes of the nomination committee meeting and the draft minutes were circulated to all committee members within a reasonable time after the meeting.

Committee composition and meeting attendance

The composition of the nomination committee during the year under review as well as the meeting attendance of the committee members are as follows:

Membership and Attendance

Work done in 2017

The nomination committee completed the following work in 2017:

- reviewed the structure, size, composition and diversity of the board;

- reviewed the board diversity policy and discussed the measurable objectives;

- recommended the appointment of a non-executive director to the board for approval; and

- made recommendations to the board on the re-election of directors retiring at the annual general meeting of the Company held on 13 June 2017.

At the meeting held in November 2017, apart from the completed work described above, the committee also noted the recent consultation paper issued by the Hong Kong Stock Exchange on the review of overboarding and time commitment of independent non-executive directors. The time and attention in which directors spent in relation to the Company was discussed in the meeting and was later also discussed in the board meeting.

Remuneration committee

The principal role of the remuneration committee is to determine the remuneration packages of individual executive directors and senior management (including salaries, bonuses, benefits in kind, pension rights and compensation payments, including any compensation payable for loss or termination of office or appointment). The remuneration committee reviews and approves the management’s remuneration proposals with reference to the board’s corporate goals and objectives, salaries paid by comparable companies, regulations promulgated by national regulatory authorities on the remuneration of directors and senior management, time commitment and responsibilities and employment conditions elsewhere in the Group, so as to align management incentives with shareholder interests.

The committee currently comprises four independent non-executive directors and a non-executive director. The chairman of the committee is Mr Anthony Francis Neoh, an independent non-executive director. The committee meets at least once a year. A joint company secretary serves as the secretary of the committee. The terms of reference are available on the Company’s website and the Hong Kong Stock Exchange’s website.

During the year under review, one remuneration committee meeting was held and one set of written resolutions was passed by all the committee members. A joint company secretary prepared full minutes of the remuneration committee meeting and the draft minutes were circulated to all committee members within a reasonable time after the meeting.

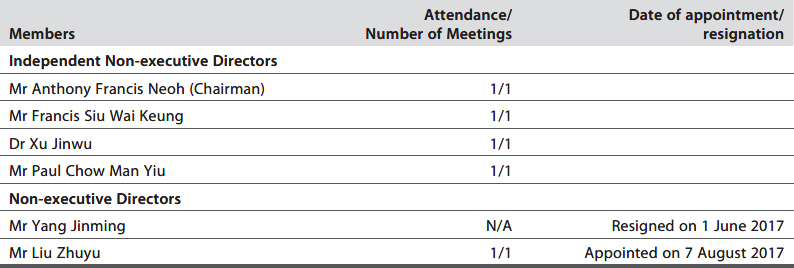

Committee composition and meeting attendance

The composition of the remuneration committee during the year under review as well as the meeting attendance of the committee members are as follows:

Membership and Attendance

Work done in 2017

The remuneration committee completed the following work in 2017:

- reviewed and approved the 2016 remuneration for executives in charge (including executive directors and senior management) of the Company in October 2017

- reviewed and approved the proposal for 2018 annual salary for executives in charge of the Company in December 2017

Details of the Company’s remuneration policies are set out in the Environmental, Social and Governance Report and directors’ remuneration and retirement benefits are disclosed.

The remuneration paid to the directors, by name, for the year ended 31 December 2017 is set out in note 12 to the consolidated financial statements.

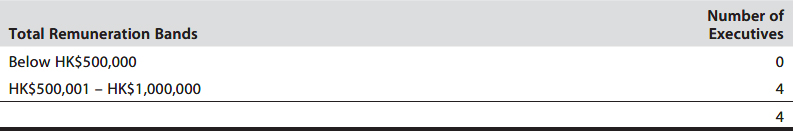

The remuneration of senior management, by band, for the year ended 31 December 2017 is set out below.

Remuneration of senior management other than directors for the full year 2017

Note:

Although the discretionary bonuses have yet to be confirmed by the relevant regulatory authority, it is expected that the unsealed remuneration will have no material impact on the financial statements of the Company for 2017.

Strategic committee

A strategic committee has been established to accommodate the strategic development of the Company and enhance its core competitiveness, make and implement the development plan of the Company, streamline the investment-related decision making procedures and procure well-advised and efficient decision making.

The strategic committee shall be accountable to and report to the board and its powers and functions are:

- considering the major strategic directions of the Company and making proposals to the board;

- considering the mid-to-long term development plan and 5-year development plan of the Company and making proposals to the board;

- considering the impact of the macro economic conditions on the development of various business sectors of the Company and making proposals to the board; and

- other matters in connection with strategy planning pursuant to authorization of the board.

The committee is chaired by Mr Chang Zhenming, the chairman of the board, and other members currently include Mr Wang Jiong (being executive director, vice chairman and president of the Company), Mr Song Kangle, Ms Yan Shuqin and Mr Yang Xiaoping (all being non-executive directors), Mr Anthony Francis Neoh and Mr Noriharu Fujita (all being independent non-executive directors). Mr Li Rucheng (being a former non-executive director of the Company) serves as a consultant to the committee. During the year under review, one strategic committee meeting was held. The Strategic Development Department prepared full minutes of the strategic committee meeting and the draft minutes were circulated to all the committee members within a reasonable time after the meeting. A joint company secretary is responsible for keeping all the minutes of the meetings.

Special committee to deal with matters relating to investigations of the Company

A special committee has been established to deal with all matters relating to all investigations (including enquiries) of, and proceedings involving, the Company and its directors, arising from the 2008 forex incident, including but not limited to by the Market Misconduct Tribunal (“MMT”), the Securities and Futures Commission and the Commercial Crime Bureau of the Hong Kong Police Force (the “Investigation”). The special committee is authorised by the board and empowered to

- approve communications between the Company and any relevant authorities or third parties in relation to the Investigation;

- consider the issue of legal professional privilege and to make decisions on behalf of the Company in connection therewith; and

- seek legal and professional advice on behalf of the Company as well as approve their fees.

The committee currently comprises two members, namely, Mr Zhang Jijing and Mr Francis Siu Wai Keung. No physical committee meetings were held during the year, and the committee members dealt with certain administrative matters (including the announcement of the MMT proceedings outcome) by way of circulation.

In respect of the appeal against the Court of First Instance’s judgment dated 19 December 2011, the Court of Appeal has on 29 June 2015 handed down a judgment on the first part of the appeal in the Company’s favour with costs. The remaining part of the appeal was adjourned in order to give the Department of Justice and the Police time to inspect the documents subject to the appeal (on a limited waiver and a completely confidential basis) to consider if they would continue to oppose the Company’s appeal. That inspection process was completed in September 2015. Subsequently, the Police/Department of Justice have agreed not to contest the remainder of the Appeal, subject to the parties’ agreement on the directions for the disposal of the Appeal. The parties have been negotiating the further directions and orders to be sought from the Court for the purpose of the disposal of the remainder of the appeal.

In respect of the proceedings brought by the Hong Kong Securities and Futures Commission at the MMT against the Company and five of its former executive directors (further particulars of which are set out in note 46(e)(i) to the Notes to the consolidated financial statements), the hearing was completed in July 2016. On 10 April 2017, the MMT handed down its decision determining that, in the publication of the Company’s circular on 12 September 2008, no market misconduct within the meaning of section 277(1) of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) took place.