Group Financial Results

Revenue

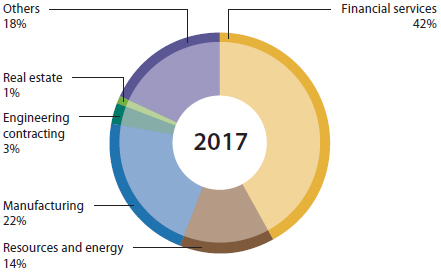

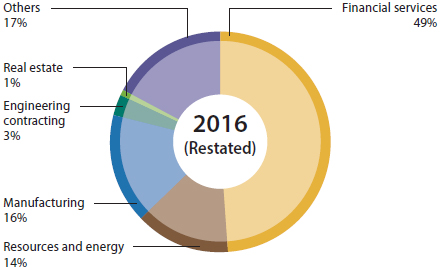

For 2017, CITIC Limited recorded revenue of HK$450,536 million from continuous operations, an increase of HK$68,874 million or 18% as compared with the same period last year.

The financial services segment recorded revenue of HK$190,028 million, an increase of HK$2,494 million or 1% from the same period last year. Excluding the impact of translation due to depreciation of average exchange rate of RMB, the corresponding increase would have been HK$5,306 million or 3%. The banking business remained the principal source of our income as CITIC Bank recorded steady income and has continued to increase the proportions of its non-interest income and retail business via actively adjusting business structure.

The resources and energy business reported revenue of HK$63,456 million, an increase of HK$12,359 million or 24% from the same period last year. The increasing demand for international commodity and energy products, the increase in both sales volume and price in trading business involving iron ore, nonferrous metals, ferroniobium, coal and other major resources and crude oil production business led to the rapid growth of revenue. The Sino Iron Project has achieved its first full year of commercial production in 2017. Revenue of HK$9,804 million was recorded and this was higher as compared to 2016.

The manufacturing business reported revenue of HK$97,432 million, an increase of HK$35,082 million or 56% from the same period last year. The rapid increase of revenue in manufacturing business was mainly driven by the global economy recovery, the increase in both sales volume and price in special steel business as well as aluminium wheels and castings business. The rapid growth of heavy equipment and robots and intelligent manufacturing also contributed revenue of HK$4,015 million to manufacturing business.

The engineering contracting business reported revenue of HK$14,653 million, an increase of HK$3,630 million 33% from the same period last year. It was mainly driven by the smooth progresses in the projects which made contribution to the revenue growth of our engineering contracting business, including the Road Upgrade project in Kazakhstan, the K.K. New Town Stage I Social Housing Municipal Infrastructure Project (Phase-II) in the Angola, the Royal Albert Dock Project in the UK, the Clean Water Project in Wuhan and the Forest Avenue Project, etc..

Affected by reduction in project settlement, the real estate business reported revenue of HK$3,227 million, a decrease of HK$1,673 million or 34% from the same period last year.

Revenue from other businesses amounted to HK$81,673 million, a year-on-year increase of HK$16,950 million or 26%, mainly attributable to revenue contribution of HK$9,515 million to the group arising from the completion of acquisition of McDonald’s Mainland China and Hong Kong businesses. Dah Chong Hong’s acquisition of IMSA and Auriga’s (formerly known as “LF Asia”) consumer and healthcare products business on end of June 2016 has drove up its revenue by HK$4,006 million. Automobile trading business maintained rapid growth. The environment business also maintained rapid growth with the spur from water treatment business and increased number of EPC projects.

| Continuing operations | Year ended 31 December | Increase/(decrease) | ||

|---|---|---|---|---|

| HK$ million | 2017 | 2016 (Restated) | Amount | % |

| Financial services | 190,028 | 187,534 | 2,494 | 1% |

| Resources and energy | 63,456 | 51,097 | 12,359 | 24% |

| Manufacturing | 97,432 | 62,350 | 35,082 | 56% |

| Engineering contracting | 14,653 | 11,023 | 3,630 | 33% |

| Real estate | 3,227 | 4,900 | (1,673) | (34%) |

| Others | 81,673 | 64,723 | 16,950 | 26% |

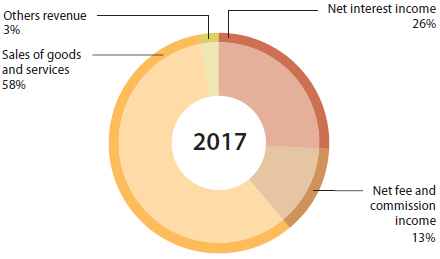

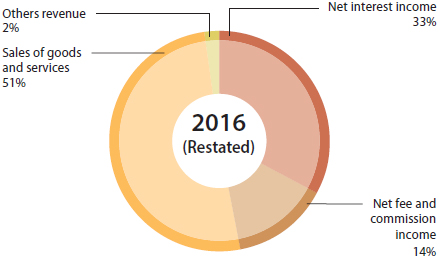

By nature

| Continuing operations | Year ended 31 December | Increase/(decrease) | ||

|---|---|---|---|---|

| HK$ million | 2017 | 2016 (Restated) | Amount | % |

| Net interest income | 116,682 | 125,919 | (9,237) | (7%) |

| Net fee and commission income | 59,180 | 54,578 | 4,602 | 8% |

| Sales of goods and services | 260,481 | 194,136 | 66,345 | 34% |

| – Sales of goods | 217,333 | 157,372 | 59,961 | 38% |

| – Services rendered to customers | 26,382 | 26,895 | (513) | (2%) |

| – Revenue from construction contracts | 16,766 | 9,869 | 6,897 | 70% |

| Other revenue | 14,193 | 7,029 | 7,164 | 102% |

Impairment losses

In 2017, the Group recorded an asset impairment of HK$78,925 million, a year-on-year increase of 7%. Of the total impairment, CITIC Bank accounted for HK$64,312 million, which mainly includes HK$57,837 million impairment on its loans and advances to customers. The other major impairment loss of HK$7,184 million (net of tax) was related to the Sino Iron Project in Australia.

Net finance charges

In 2017, finance costs amounted to HK$11,497 million, an increase of HK$2,789 million or 32% compared with the same period last year, mainly attributable to a year-on-year increase in debt size.

In 2017, finance income from operation management and subsidiaries in the non-financial segments amounted to HK$1,412 million, a year-on-year decrease of HK$163 million or 10%, mainly attributable to interest income on bank deposits.

Interest expense capitalised

In 2017, interest expense capitalised amounted to HK$361 million, a year-on-year decrease of HK$215 million or 37%. This was mainly because that the 6 production lines of Sino Iron were in full operation in May 2016, interest expense capitalized decreased correspondingly.

Income tax

In 2017, income tax of the Group was HK$17,687 million, a decrease of HK$717 million compared with the same period last year. It was mainly because the income tax of our company decreased as a result of the increase of non-taxable income.