Report of The Directors

The directors have pleasure in presenting to shareholders their report for the year ended 31 December 2017.

Principal Activities

The Company is China’s largest conglomerate. The principal activity of the Company is investment holding and its subsidiaries are engaged in financial services, resources and energy, manufacturing, engineering contracting and real estate as well as other businesses both in China and overseas.

Subsidiary Companies

The name of the principal subsidiaries, the place of incorporation and shares issued are set out in Note 58 to the consolidated financial statements.

Business Review

A fair review, discussion and analysis of the Group’s business as required by Schedule 5 to the Companies Ordinance (Cap 622 of the laws of Hong Kong), including the material factors underlying its results and financial position are set out in the sections headed “Chairman’s Letter to Shareholders”, “Our Businesses” and “Financial Review” of this annual report. An account of the principal risks and uncertainties facing the Group is provided in the “Risk Management” section of this annual report. Particulars of important events affecting the Company that have occurred since the end of the financial year 2017 (if any) and the likely future development in the Company’s business can also be found in this annual report. The above discussions form an integral part of the Directors’ Report.

In addition, an account of the Company’s performance by reference to environmental and social-related policies is provided in the “Environmental, Social and Governance Report” of this annual report.

Dividends

The directors declared an interim dividend of HK$0.11 per share (2016: HK$0.10 per share) for the year ended 31 December 2017 which was paid on 29 September 2017. The directors recommended, subject to approval of the shareholders at the forthcoming annual general meeting of the Company to be held on 14 June 2018 (the “2018 AGM”), the payment of a final dividend of HK$0.25 per share (2016: HK$0.23 per share) in respect of the year ended 31 December 2017, payable on Thursday, 5 July 2018 to shareholders on the Company’s register of members at the close of business on 25 June 2018. This represents a total distribution for the year of HK$10,473 million.

Donations

Donations made by the Company and its subsidiary companies during the year are set out in the “Environmental, Social and Governance Report” of this annual report.

Share Capital and Reserves

Movements in the share capital and reserves of the Company and the Group during the year are set out in Note 44 to the consolidated financial statements.

Fixed Assets

Movements in fixed assets during the year are set out in Note 32 to the consolidated financial statements.

Major Customers and Suppliers

During the year, both the aggregate percentage of purchases from the Group’s five largest suppliers and the aggregate percentage of sales to the Group’s five largest customers were less than 30% of total purchases and sales of the Group respectively.

None of the directors, their associates nor any shareholders (which to the best knowledge and belief of the directors own more than 5% of the Company’s issued shares) had interest during the year in the above suppliers or customers.

Borrowings, Debt Instruments Issued and Perpetual Capital Securities

Particulars of borrowings, debt instruments issued and perpetual capital securities of the Company and its subsidiary companies as at 31 December 2017 are set out in Notes 41, 42 and 44 to the consolidated financial statements.

Equity-linked Agreements

Save as disclosed below in the section headed “Share Option Plan Adopted by the Company”, no equity-linked agreements that will or may result in the Company issuing shares or that require the Company to enter into any agreements that will or may result in the Company issuing shares were entered into by the Company during the year or subsisted at the end of the year.

Directors

The directors of the Company during the year and up to the date of this report are:

Executive Directors Mr Chang Zhenming (Chairman) Mr Wang Jiong (Vice Chairman and President) Ms Li Qingping Mr Pu Jian

Non-executive Directors Mr Liu Yeqiao Mr Song Kangle Ms Yan Shuqin Mr Yang Jinming (resigned on 1 June 2017) Mr Liu Zhuyu (appointed on 7 August 2017) Mr Liu Zhongyuan Mr Yang Xiaoping Mr Wu Youguang (appointed on 20 March 2018)

Independent Non-executive Directors Mr Francis Siu Wai Keung Dr Xu Jinwu Mr Anthony Francis Neoh Ms Lee Boo Jin Mr Noriharu Fujita Mr Paul Chow Man Yiu

Mr Yang Jinming resigned as a non-executive director of the Company with effect from 1 June 2017 and confirmed that he has no disagreement with the board and nothing relating to the affairs of the Company needs to be brought to the attention of the shareholders of the Company.

Pursuant to Article 95 of the Company’s articles of association, Mr Liu Zhuyu and Mr Wu Youguang who were appointed as directors of the Company by the board since the last annual general meeting shall hold office only until the 2018 AGM and shall then be eligible for re-election at such meeting. Thereafter, they shall be subject to retirement by rotation and re-election in accordance with the Company’s articles of association.

Pursuant to Article 104(A) of the Company’s articles of association, Mr Wang Jiong, Mr Song Kangle, Mr Yang Xiaoping, Mr Francis Siu Wai Keung and Mr Anthony Francis Neoh shall retire by rotation at the 2018 AGM and, all being eligible, shall offer themselves for re-election at such meeting.

The biographical details of directors and senior management as at the date of this report are set out in the “Board of Directors” and “Senior Management” sections of this annual report.

Directors of Subsidiaries

The list of directors who have served on the boards of the subsidiaries of the Company during the year and up to the date of this report is available on the Company’s website at www.citic.com.

Directors’ Material Interests in Transactions, Arrangements or Contracts

Save as disclosed in the sections headed “Connected Transactions” and “Non-Exempt Continuing Connected Transactions” below and “Material related parties” in Note 48 to the consolidated financial statements, no transactions, arrangements or contracts of significance in relation to the Company’s business to which the Company’s subsidiaries, fellow subsidiaries or its holding company was a party or were parties and in which a director of the Company or his or her connected entity had a material interest, whether directly or indirectly, subsisted at the end of the year or at any time during the year.

Directors’ Service Contracts

None of the directors proposed for re-election at the forthcoming annual general meeting has a service contract with the Group which is not determinable by the Group within one year without payment of compensation (other than statutory compensation).

Management Contracts

No contracts concerning the management and administration of the whole or any substantial part of the business of the Company were entered into during the year or existed at the end of the year.

Permitted Indemnity

Pursuant to the Company’s articles of association and subject to the provisions of the Companies Ordinance (Cap 622 of the Laws of Hong Kong), every director or other officer of the Company shall be entitled to be indemnified out of the assets of the Company against all losses or liabilities which he/she may sustain or incur in or about the execution of the duties of his/her office or otherwise in relation thereto. The Company has arranged Directors & Officers Liability and Company Reimbursement Insurance for its directors and officers to protect them against potential costs and liabilities arising from claims brought against them.

Related Party Transactions

The Company and its subsidiaries entered into certain transactions in the ordinary course of business and on normal commercial terms which were “Material Related Party Transactions”, the details of which are set out in Note 48 to the consolidated financial statements of the Company. Some of these transactions also constitute “Connected Transactions” and/or “Continuing Connected Transactions” under the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”) as summarised below.

Connected Transactions

Set out below is information in relation to certain connected transactions involving the Company and/or its subsidiaries, particulars of which were previously disclosed in the announcements of the Company and are required under the Listing Rules to be disclosed in this annual report and the consolidated financial statements of the Company. The full text of each announcement can be found on https://www.citic.com/en/investor_relation/announcements_circulars/.

-

On 29 September 2017, CITIC Metal Group Limited (“CITIC Metal”, an indirect wholly-owned subsidiary of the Company) and Star Thrive Investments Limited (“Star Thrive”, a special purpose vehicle holding 76.37% equity interest in Jinzhou Titanium Industry Co., Ltd.) entered into a new share subscription agreement (the “New Share Subscription Agreement”) pursuant to which CITIC Metal agreed to subscribe for 1,114,008,534 new shares issued by Star Thrive, representing 60% of the enlarged share capital of Star Thrive at a consideration of HK$1,325,770,960.

CITIC Group is the controlling shareholder of the Company and therefore is a connected person of the Company. Star Thrive constitutes a connected person of the Company by virtue of being an indirect whollyowned subsidiary of CITIC Group. Accordingly, the entering into of the New Share Subscription Agreement constitutes a connected transaction for the Company under the Listing Rules.

-

On 24 October 2017, Jiangyin Xingcheng Special Steel Works Co., Ltd. (“Xingcheng Special Steel”, an indirect wholly-owned subsidiary of the Company) and CITIC Group entered into an equity transfer agreement (the “Equity Transfer Agreement”) through the public tender process on the China Beijing Equity Exchange. Pursuant to the Equity Transfer Agreement, Xingcheng Special Steel (as the sole bidder) agreed to acquire 100% equity interest held by CITIC Group in Qingdao Special Iron and Steel Co., Ltd. at a consideration of RMB127,236,600 (approximately HK$149,758,831).

CITIC Group is the controlling shareholder of the Company and therefore is a connected person of the Company. Accordingly, the entering into of the Equity Transfer Agreement constitutes a connected transaction for the Company under the Listing Rules.

Non-Exempt Continuing Connected Transactions

During the year under review, the Group engaged in the following non-exempt continuing connected transactions with CITIC Group Corporation (“CITIC Group”) and/or its associates (the “Connected Persons”), particulars of which were previously disclosed in the announcements of the Company and are required under the Listing Rules to be disclosed in this annual report and the consolidated financial statements of the Company.

-

Sales Framework Agreement — sale of manganese ore by the Group to the Connected Persons

The original Sales Framework Agreement dated 30 September 2014 ended on 31 December 2016. As the Company and CITIC Group intend to continue to carry out the relevant transactions, both parties entered into a new sales framework agreement (“New Sales FA”) on 30 November 2016, details of which were set out in the Company’s announcement dated 30 November 2016.

New Sales FA

Period: commencing from 1 January 2017 and ending on 31 December 2019 Annual for year ended 31/12/2017 for year ending 31/12/2018 for year ending 31/12/2019 Caps: RMB840,000,000 RMB1,050,000,000 RMB1,050,000,000 The transaction amount under the New Sales FA for the year ended 31 December 2017 was approximately RMB86,912,934.45.

-

Advertising and Promotion Framework Agreement — provision of advertising and promotion services by the Group to the Connected Persons

The original Advertising and Promotion Framework Agreement dated 30 September 2014 ended on 31 December 2014. As the Company and CITIC Group intend to continue to carry out the relevant transactions, both parties entered into a new advertising and promotion framework agreement (“New Advertising and Promotion FA”) on 30 March 2015, details of which were set out in the Company’s announcement dated 30 March 2015.

New Advertising and Promotion FA

Period: commencing from 30 March 2015 and ended on 31 December 2017 Annual for year ended 31/12/2017 Caps: RMB550,000,000 There were no transactions under the New Advertising and Promotion FA for the year ended 31 December 2017.

-

Financial Assistance Framework Agreement — financial assistance provided by the Group to the Connected Persons in the form of entrusted loans or commercial loans

The original Financial Assistance Framework Agreement dated 30 September 2014 ended on 31 December 2016. As the Group intend to continue to provide financial assistance to the Connected Persons in the form of entrusted loans and commercial loans, the Company and CITIC Group entered into a new financial assistance framework agreement (“New Financial Assistance FA”) on 30 November 2016. Details of the above were set out in the Company’s announcement dated 30 November 2016.

New Financial Assistance FA

Period: commencing from 1 January 2017 and ending on 31 December 2019 Maximum for year ended 31/12/2017 for year ending 31/12/2018 for year ending 31/12/2019 Daily Balance: RMB9,500,000,000 RMB10,200,000,000 RMB11,000,000,000 The maximum daily balance of the financial assistance under the New Financial Assistance FA for the year ended 31 December 2017 was approximately RMB3,477,500,000.

-

Reference is made to the announcement dated 8 December 2014 and the circular dated 2 January 2015 issued by China CITIC Bank Corporation Limited (“CITIC Bank”, a non-wholly-owned subsidiary of the Company), with respect to, among other things, the asset transfer framework agreement (the “Original Asset Transfer FA”) entered into on 8 December 2014 between CITIC Bank and CITIC Group in relation to the transfer of loan and other related assets between CITIC Bank and the Connected Persons which constitute continuing connected transactions of the Company. Details of the above are set out in the Company’s announcement dated 30 March 2015. The Original Asset Transfer FA dated 8 December 2014 ended on 31 December 2017.

Original Asset Transfer FA

Annual for year ended 31/12/2017 Cap: RMB12,600,000,000 There were no transactions under the Original Asset Transfer FA for the year ended 31 December 2017.

Reference is also made to the announcement dated 24 August 2017 and the circular dated 1 November 2017 issued by CITIC Bank whereby, among other things, a new asset transfer framework agreement (the “New Asset Transfer FA”) was entered into on 24 August 2017 between CITIC Bank and CITIC Group for renewal of the Original Asset Transfer FA dated 8 December 2014. Details of the above are set out in the Company’s announcements dated 23 November 2017 and 6 December 2017.

New Asset Transfer FA

Annual for year ending 31/12/2018 for year ending 31/12/2019 for year ending 31/12/2020 Caps: RMB13,000,000,000 RMB13,000,000,000 RMB13,000,000,000 -

Reference is made to the announcement dated 8 December 2014 and the circular dated 2 January 2015 issued by CITIC Bank, with respect to, among other things, the wealth management and investment service agreement (the “Wealth Management and Investment Service Agreement”) entered into on 8 December 2014 between CITIC Bank and CITIC Group in relation to transactions of (i) non-principal-guaranteed wealth management and agency services; (ii) principal-guaranteed wealth management; and (iii) investment with CITIC Bank’s own funds contemplated under the Wealth Management and Investment Service Agreement (collectively the “Wealth Management and Investment Transactions”).

Under the Wealth Management and Investment Service Agreement, the Wealth Management and Investment Transactions with the Connected Persons, including but not limited to Ningbo Xinning Industrial Investment Corporation Limited and CITIC Ningbo Group Corporation, constitute continuing connected transactions of the Company. Details of the above were set out in the Company’s announcement dated 29 March 2016.

Non-principal-guaranteed wealth management and agency services

Annual for year ended 31/12/2017 Cap: (Service Fees) RMB300,000,000 The service fees in respect of non-principal-guaranteed wealth management and agency services under the Wealth Management and Investment Service Agreement for the year ended 31 December 2017 was approximately RMB22,700.

Principal-guaranteed wealth management and investment services

Annual Cap: for year ended 31/12/2017 (Proceeds & Cost — Bank Investment) RMB960,000,000 Maximum Daily for year ended 31/12/2017 Balance: (Investment) RMB10,800,000,000 There were no transactions in respect of principal-guaranteed wealth management and investment services under the Wealth Management and Investment Service Agreement for the year ended 31 December 2017.

The independent non-executive directors of the Company have reviewed the aforesaid continuing connected transactions for the year ended 31 December 2017 (the “Transactions”) and confirm that:

- the Transactions have been entered into in the ordinary and usual course of business of the Group;

- the Transactions have been entered into on normal commercial terms or better; and

- the Transactions were entered into according to the relevant agreements governing them on terms that are fair and reasonable and in the interests of the shareholders of the Company as a whole.

The Company’s auditor was engaged to report on the Group’s continuing connected transactions in accordance with Hong Kong Standard on Assurance Engagements 3000 (Revised) “Assurance Engagements Other Than Audits or Reviews of Historical Financial Information” and with reference to Practice Note 740 “Auditor’s Letter on Continuing Connected Transactions under the Hong Kong Listing Rules” issued by the Hong Kong Institute of Certified Public Accountants. The auditor issued an unqualified letter containing findings and conclusions in respect of the continuing connected transactions disclosed by the Group in accordance with Rule 14A.56 of the Listing Rules. A copy of the auditor’s letter has been provided by the Company to The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”).

Share Option Plan Adopted by the Company

CITIC Pacific Share Incentive Plan 2011

The CITIC Pacific Share Incentive Plan 2000 adopted by the Company on 31 May 2000 for a term of ten years expired on 30 May 2010. The Company adopted a new plan, the CITIC Pacific Share Incentive Plan 2011 (the “Plan 2011”) on 12 May 2011. The major terms of the Plan 2011 are as follows:

- The purpose of the Plan 2011 is to promote the interests of the Company and its shareholders by (i) providing the eligible participants with additional incentives to continue and increase their efforts in achieving success in the business of the Group, and (ii) attracting and retaining the best available personnel to participate in the on-going business operation of Group.

- The eligible participants of the Plan 2011 are any employee, executive director, non-executive director, independent non-executive director or officer, consultant or representative of any member of the Company as the board may in its discretion select.

- The total number of shares which may be issued upon exercise of all options to be granted under the Plan 2011 must not in aggregate exceed 10% of the shares in issue as at the date of adopting the Plan 2011. As at 28 March 2018, the total number of shares available for issue under the Plan 2011 is 364,944,416 shares.

- The total number of shares issued and to be issued upon exercise of options (whether exercised or outstanding) in any 12-month period granted to each participant must not exceed 1% of the shares of the Company in issue. Where any further grant of options to a participant would result in the shares issued and to be issued upon exercise of all options granted and to be granted to such person (including exercised, cancelled and outstanding options) in the 12-month period up to and including the date of such further grant representing in aggregate over 1% of the Company’s shares in issue, such further grant shall be subject to separate approval by the shareholders of the Company in general meeting.

- The exercise period of any option granted under the Plan 2011 must not be more than ten years commencing on the date of offer of the grant.

- The acceptance of an offer of the grant of the option must be made within 28 days from the date of grant with a non-refundable payment of HK$1.00 from the grantee.

- The subscription price determined by the board will be at least the higher of (i) the nominal value of the Company’s shares; (ii) the closing price of the Company’s shares as stated in the Hong Kong Stock Exchange’s daily quotations sheet on the date of offer of the grant; and (iii) the average of the closing prices of the Company’s shares as stated in the Hong Kong Stock Exchange’s daily quotations sheets for the five business days immediately preceding the date of offer of the grant.

- The Plan 2011 shall be valid and effective until 11 May 2021.

No share options were granted under the Plan 2011 during the year ended 31 December 2017.

Share Option Plan Adopted by Subsidiaries of the Company

CITIC Telecom International Holdings Limited (“CITIC Telecom”)

CITIC Telecom adopted a share option plan (the “CITIC Telecom Share Option Plan”) on 17 May 2007. The major terms of the CITIC Telecom Share Option Plan are as follows:

- The purpose of the CITIC Telecom Share Option Plan is to attract and retain the best quality personnel for the development of CITIC Telecom’s businesses; to provide additional incentives to CITIC Telecom Directors, Officers and Employees (as defined here below); and to promote the long term financial success of CITIC Telecom by aligning the interests of grantees to shareholders of CITIC Telecom.

- The grantees of the CITIC Telecom Share Option Plan are any person employed by CITIC Telecom or any of its subsidiaries and any person who is an officer or director (whether executive or non-executive) of CITIC Telecom or any of its subsidiaries (collectively the “CITIC Telecom Directors, Officers and Employees”) as the board of CITIC Telecom may, in its absolute discretion, select.

- The total number of shares of CITIC Telecom (the “CITIC Telecom Shares”) issued and to be issued upon exercise of options (whether exercised or outstanding) in any 12-month period granted to each grantee must not exceed 1% of the CITIC Telecom Shares in issue. Where any further grant of options to a grantee would result in the CITIC Telecom Shares issued and to be issued upon exercise of all options granted and to be granted to such person (including exercised, cancelled and outstanding options) in the 12-month period up to and including the date of such further grant representing in aggregate over 1% of the CITIC Telecom Shares in issue, such further grant shall be subject to separate approval by the shareholders of CITIC Telecom in general meeting.

- The exercise period of any option granted under the CITIC Telecom Share Option Plan must not be more than ten years commencing on the date of grant.

- The acceptance of an offer of the grant of the options must be made within 28 days from the date of grant with a non-refundable payment of HK$1.00 from the grantee.

- The subscription price determined by the board of CITIC Telecom will not be less than the higher of (i) the closing price of CITIC Telecom’s shares as stated in the daily quotations sheet of the Hong Kong Stock Exchange on the date of grant; and (ii) the average closing price of CITIC Telecom’s shares as stated in the Hong Kong Stock Exchange’s daily quotations sheets for the five business days immediately preceding the date of grant.

- The CITIC Telecom Share Option Plan was valid and effective till 16 May 2017.

As approved at the annual general meeting of CITIC Telecom held on 25 April 2014, the mandate limit is refreshed so that taking into account the overriding limit of the CITIC Telecom Share Option Plan, the total number of the CITIC Telecom Shares which may be issued upon the exercise of all options to be granted under the CITIC Telecom Share Option Plan, together with all outstanding options granted and yet to be exercised under the CITIC Telecom Share Option Plan, shall not exceed 333,505,276 CITIC Telecom Shares, being 10% of the number of the CITIC Telecom Shares in issue as at the date of approval of the refreshment of the mandate limit.

Since the adoption of the CITIC Telecom Share Option Plan, CITIC Telecom has granted the following share options:

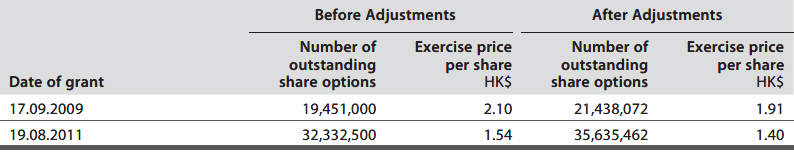

Upon completion of the rights issue of CITIC Telecom on 7 June 2013, the exercise price and the number of shares to be allotted and issued upon full exercise of the subscription rights attaching to the outstanding share options of CITIC Telecom as at 6 June 2013 have been adjusted (the “Adjustments”) in the following manner:

The grantees were CITIC Telecom Directors, Officers and Employees. None of these options were granted to the directors, chief executives or substantial shareholders of the Company.

The share options granted on 23 May 2007 and 17 September 2009 have expired. In addition, the first 50% of the share options granted on 19 August 2011 have expired at the close of business on 18 August 2017. The remaining options granted and accepted under the CITIC Telecom Share Option Plan can be exercised in whole or in part within 5 years from the date of commencement of the exercise period.

As at 1 January 2017, options for 140,533,659 CITIC Telecom Shares were outstanding under the CITIC Telecom Share Option Plan. During the year ended 31 December 2017, options for 9,582,531 CITIC Telecom Shares were exercised, options for 5,086,319 CITIC Telecom Shares have lapsed and options for 1,513,000 CITIC Telecom Shares were cancelled. As at 31 December 2017, options for 128,174,809 CITIC Telecom Shares under the CITIC Telecom Share Option Plan were exercisable.

The closing price of CITIC Telecom Shares immediately before the grant on 24 March 2017 was HK$2.39.

A summary of the movements of the share options during the year ended 31 December 2017 is as follows:

A. Employees of the Company/CITIC Telecom under continuous contracts (as defined in the Employment Ordinance)

B. Others (Note 4)

Notes:

(1) The weighted average closing price of CITIC Telecom Shares immediately before the dates on which the options were exercised was HK$2.35.

(2) These are in respect of options granted to some employees under continuous contracts who had not accepted the options. These options had been cancelled during the year ended 31 December 2017.

(3) These are in respect of options i) granted to some employees under continuous contracts who have subsequently resigned; or ii) lapsed upon the expiry of the relevant share options during the year.

(4) These are in respect of options granted to independent non-executive directors (including a former independent non-executive director who retired on 1 June 2017) of CITIC Telecom who are not employees under continuous contracts. None of these options were cancelled or lapsed during the year ended 31 December 2017.

The average fair value of an option on one ordinary share of CITIC Telecom measured at the date of grant of 24 March 2017 was HK$0.558 based on the following assumptions using the binomial option pricing model:

- Taking into account the probability of early exercise behaviour, the average expected term of the grant for directors and employees was determined to be 6.0 years and 4.2 years respectively;

- Expected volatility of CITIC Telecom’s share price at 38% per annum (based on historical movements of CITIC Telecom’s share prices);

- Expected annual dividend yield of 4.2%;

- Expected post-vesting exit rate of 0% per annum for directors and 15.0% per annum for employees;

- Early exercise assumption for directors and employees to exercise their options when the share price is at least 250% and 161% of the exercise price respectively; and

- Risk-free interest rate of 1.47% and 1.53% for the first 50% and the remaining 50% of the options respectively (based on linearly interpolated yields of the Hong Kong Exchange Fund Notes at the grant date).

The result of the binomial option pricing model can be materially affected by changes in these assumptions so an option’s actual value may differ from the estimated fair value of the options due to limitations of the model.

The total expense recognised in CITIC Telecom Group’s consolidated income statement for the year ended 31 December 2017 in respect of options granted by CITIC Telecom was HK$31,980,000 (2016: HK$20,220,000).

Dah Chong Hong Holdings Limited (“Dah Chong Hong”)

Dah Chong Hong adopted a share option scheme (the “DCHH Scheme”) on 28 September 2007 which was valid and effective till 27 September 2017, after which no further share options will be granted. The major terms of the DCHH Scheme are as follows:

- The purpose of the DCHH Scheme is to attract and retain the best quality personnel for the development of Dah Chong Hong’s businesses; to provide additional incentives to the employees of the Dah Chong Hong group and to promote the long term financial success of Dah Chong Hong by aligning the interests of grantees to Dah Chong Hong’s shareholders.

- The participants of the DCHH Scheme are any employee of the Dah Chong Hong group as the board of Dah Chong Hong may in its absolute discretion select.

- The maximum number of shares over which share options may be granted under the DCHH Scheme and any other schemes of Dah Chong Hong shall not in aggregate exceed 10% of (i) the shares of Dah Chong Hong in issue immediately following the commencement of dealings in Dah Chong Hong’s shares on the Hong Kong Stock Exchange or (ii) the shares of Dah Chong Hong in issue from time to time, whichever is the lower. As at 28 March 2018, the maximum number of shares available for issue under the DCHH Scheme is 139,550,000, representing approximately 7.56% of the issued shares of Dah Chong Hong. Share options lapsed in accordance with the terms of the DCHH Scheme or any other schemes of Dah Chong Hong will not be counted for the purpose of calculating the 10% limit.

- The total number of shares issued and to be issued upon exercise of share options (whether exercised or outstanding) in any 12-month period granted to each grantee must not exceed 1% of the shares of Dah Chong Hong in issue.

- The exercise period of any share option granted under the DCHH Scheme must not be more than 10 years commencing on the date of grant.

- The acceptance of an offer of the grant of the share option must be made within 28 days from the date of grant with a non-refundable payment of HK$1 from the grantee.

- The subscription price determined by the board of Dah Chong Hong will not be less than whichever is the higher of (i) the closing price of Dah Chong Hong’s shares as stated in the Hong Kong Stock Exchange’s daily quotations sheets on the date of grant; and (ii) the average closing price of Dah Chong Hong’s shares as stated in the Hong Kong Stock Exchange’s daily quotations sheets for the 5 business days immediately preceding the date of grant.

- The DCHH Scheme was valid and effective till 27 September 2017, after which no further share options will be granted.

DCHH Scheme has expired on 27 September 2017.

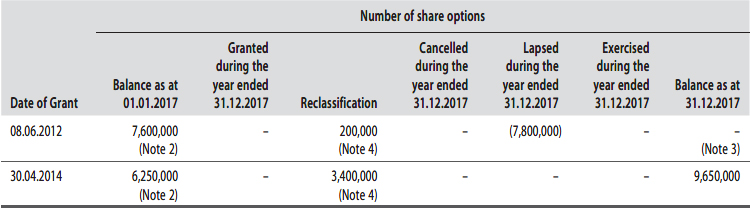

During the period between the adoption of the DCHH Scheme and its expiry, Dah Chong Hong has granted the following share options:

* Subject to a vesting scale

The share options granted on 7 July 2010 had expired by the close of business on 6 July 2015.

Of the share options granted on 8 June 2012, 24,250,000 were accepted and 200,000 were not as at the latest date of acceptance pursuant to the scheme rules (i.e. 5 July 2012). The share options granted are subject to a vesting scale. 25% of the options granted will vest on the first anniversary of the date of grant. A further 25% will vest on the second anniversary of the date of grant and the remaining 50% of the share options granted will vest on the third anniversary of the date of grant. The vested options are exercisable in whole or in part within 5 years from the date of grant. The closing price of the shares of Dah Chong Hong immediately before the grant on 8 June 2012 was HK$7.49 per share. The share options expired by the close of business on 7 June 2017.

Of the share options granted on 30 April 2014, 27,850,000 were accepted and 350,000 were not as at the latest date of acceptance pursuant to the scheme rules (i.e. 28 May 2014). The share options granted are subject to a vesting scale. 25% of the options granted will vest on the first anniversary of the date of grant. A further 25% will vest on the second anniversary of the date of grant and the remaining 50% of the share options granted will vest on the third anniversary of the date of grant. The vested options are exercisable in whole or in part within 5 years from the date of grant. The closing price of the shares of Dah Chong Hong immediately before the grant on 30 April 2014 was HK$4.91 per share. The remaining contractual life of the share options is 1.3 years.

The grantees were certain directors or employees of Dah Chong Hong group working under continuous contracts (as defined in the Employment Ordinance). None were granted to the directors, chief executives or substantial shareholders of the Company.

(a) Employees of the Dah Chong Hong group working under continuous contracts (as defined in the Employment Ordinance)

(b) Others (Note 1)

Notes:

(1) These are in respect of share options granted to former employees whose employment was terminated other than for cause or misconduct.

(2) 1,800,000 share options (granted on 8 June 2012) and 1,800,000 share options (granted on 30 April 2014) were added to the opening balance in “Others” subsequent to certain employees having retired on 1 January 2017.

(3) Share options granted on 8 June 2012 had expired by the close of business on 7 June 2017.

(4) 200,000 share options (granted on 8 June 2012) were added to the lapsed column in “Others” and 3,400,000 share options (granted on 30 April 2014) were added to the closing balance in “Others” subsequent to certain employees having retired during the year ended 31 December 2017.

As at 1 January 2017, options for 45,600,000 Dah Chong Hong’s shares were outstanding under the DCHH Scheme. During the year ended 31 December 2017, options for 22,650,000 Dah Chong Hong’s shares were lapsed and none of the options were exercised and cancelled. As at 31 December 2017, options for 22,950,000 Dah Chong Hong’s shares under the DCHH Scheme were exercisable.

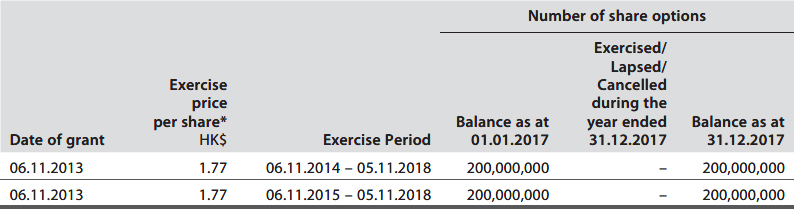

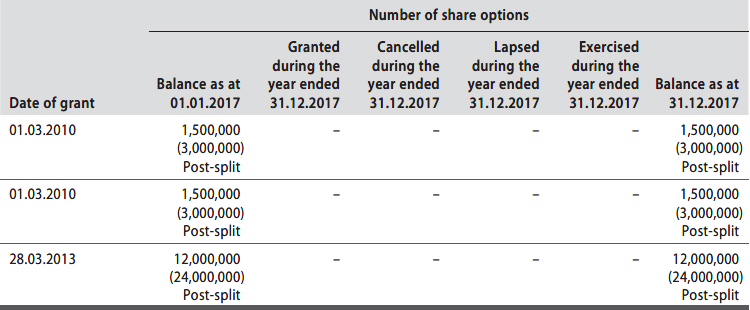

CITIC Resources Holdings Limited (“CITIC Resources”)

CITIC Resources adopted a share option scheme on 30 June 2004 (the “Old Scheme”) for a term of 10 years, which expired on 29 June 2014. The share options that have been granted under the Old Scheme and remained outstanding as at the date of expiry of the Old Scheme remain valid and exercisable subject to and in accordance with the terms of the Old Scheme.

A summary of the movements of the share options of CITIC Resources under the Old Scheme during the year ended 31 December 2017 is as follows:

* The exercise price of the share options is subject to adjustment in case of a rights issue or bonus issue, or other similar changes in the share capital of CITIC Resources.

Notes: The share options are subject to the following vesting conditions:

(i) 50% of the share options vest and are exercisable with effect from the first anniversary of the date of grant; and

(ii) the remaining 50% of the share options vest and are exercisable with effect from the second anniversary of the date of grant.

The grantee is a director of CITIC Resources.

As at 31 December 2017, CITIC Resources had 400,000,000 share options outstanding under the Old Scheme.

To enable CITIC Resources to continue to grant share options as an incentive or reward to eligible persons, a new share option scheme was adopted by CITIC Resources on 27 June 2014 (the “New Scheme”).

Pursuant to the New Scheme, CITIC Resources may grant options to eligible persons to subscribe for shares of CITIC Resources subject to the terms and conditions stipulated therein. A summary of some of the principal terms of the New Scheme is as follows:

- To allow CITIC Resources (i) to be competitive and to be able to attract, retain and motivate appropriate personnel to assist the CITIC Resources group attain its strategic objectives by offering share options to enhance general remuneration packages; (ii) to align the interests of the directors and employees of the CITIC Resources group with the performance of CITIC Resources and the value of the shares; and (iii) to align the commercial interests of business associates, customers and suppliers of the CITIC Resources group with the interests and success of the CITIC Resources group.

- The eligible persons include employees and directors of CITIC Resources and any of its subsidiaries (including their respective executive and non-executive directors), business associates and advisers who will provide or have provided services to the CITIC Resources group.

- The total number of shares which may be issued upon the exercise of all outstanding options granted under the New Scheme and any other schemes of CITIC Resources shall not exceed 10% of the total number of shares of CITIC Resources in issue as at the date of adoption of the New Scheme.

- The total number of shares issued and to be issued upon the exercise of the options granted to an eligible person (including any exercised, cancelled and outstanding options) in any 12-month period up to and including the date of grant shall not exceed 1% of the total number of shares of CITIC Resources in issue at the date of grant.

- The period during which an option may be exercised is determined by the board of directors of CITIC Resources at its absolute discretion, except that no option may be exercised after 10 years from the date of grant.

- The minimum period for which an option must be held before it can be exercised is one year.

- The exercise price payable in respect of each share of CITIC Resources shall be not less than the greater of (i) the closing price of the shares of CITIC Resources on the Hong Kong Stock Exchange as stated in the Hong Kong Stock Exchange’s daily quotations sheet on the date of grant (which must be a business day); (ii) the average closing price of the shares of CITIC Resources on the Hong Kong Stock Exchange as stated in the Hong Kong Stock Exchange’s daily quotations sheets for the five business days immediately preceding the date of grant; and (iii) the nominal value of the shares of CITIC Resources.

- The New Scheme remains in force until 26 June 2024 unless otherwise terminated in accordance with the terms stipulated therein.

Share options do not confer rights on the holders to dividends or to vote at general meetings.

No share options were granted under the New Scheme during the year ended 31 December 2017.

CITIC Envirotech Ltd. (“CITIC Envirotech”)

CITIC Envirotech is a company incorporated in Singapore and whose shares are listed on the main board of the Singapore Exchange. It adopted the Employee Share Option Scheme (the “Scheme”) on 2 February 2010. A summary of some of the principal terms of the Scheme is as follows:

-

The Scheme is primarily a share incentive scheme. It provides CITIC Envirotech with the means to use share options as part of a compensation scheme for attracting as well as promoting long-term staff retention. The objectives of the Scheme are (a) to motivate each participant to optimise his performance standards and efficiency and to maintain a high level of contribution to the CITIC Envirotech group; (b) to make employee remuneration sufficiently competitive to recruit and retain participants whose contributions are important to the long-term growth and profitability of the CITIC Envirotech group; (c) to instil loyalty to, and a stronger identification by the participants with the long-term development and growth of, CITIC Envirotech; (d) to attract potential employees with relevant skills to contribute to the CITIC Envirotech group and to create value for the shareholders; (e) to align the interests of the participants with the interests of the shareholders; and (f) to give recognition to the contributions made or to be made by the CITIC Envirotech group non-executive directors (including independent directors) to the success of the CITIC Envirotech group.

-

The participants of the Scheme are group employees (including group executive directors) and group nonexecutive directors (including independent directors) of CITIC Envirotech.

-

The aggregate number of shares in respect of which options may be granted on any date under the Scheme, when added to the amount of shares issued and issuable and/or transferred and transferable in respect of:

(a) all shares available under the Scheme; and

(b) all shares, options or awards granted under any other share option or share scheme of CITIC Envirotech then in force,

shall not exceed 15% of the number of issued shares (excluding treasury shares) of CITIC Envirotech on the day immediately preceding the relevant date of grant (or such other limit as the Singapore Exchange may determine from time to time). The options which have already been granted shall not be invalidated in the event that a reduction of CITIC Envirotech’s capital or a buy back of its shares (if applicable) results in the shares issuable and/or transferable under outstanding options exceeding 15% of CITIC Envirotech’s issued share capital (excluding treasury shares).

The aggregate number of shares issued and issuable and/or transferred and transferable in respect of all options granted pursuant to the Scheme available to all controlling shareholders and their associates of CITIC Envirotech shall not exceed 25% of the shares available under the Scheme.

The number of shares issued and issuable and/or transferred and transferable in respect of all options granted pursuant to the Scheme available to each controlling shareholder or each of his associates of CITIC Envirotech shall not exceed 10% of the shares available under the Scheme.

-

The aggregate number of shares in respect of which options may be offered to a grantee for subscription in accordance with the Scheme shall be determined at the discretion of the remuneration committee of CITIC Envirotech who shall take into account criteria such as rank, past performance, years of service and potential for future development of the participant.

-

If the options remain unexercised after a period of 10 years (executive directors and employees) and 5 years (non-executive directors) from the date of grant, the options expire. Options are forfeited if the employee leaves the group before the options vest.

-

The vesting period is 1 year for non-discount options and 2 years for discounted options.

-

The consideration for the grant of an option is S$1.00.

-

The exercise price is based on the price that is equivalent to the Market Price*; or a price that is set at a discount to the Market Price, provided always that the maximum discount shall not exceed 20% of the Market Price; and the prior approval of shareholders shall have been obtained in a separate resolution.

* Market Price: a price equal to the average of the last dealt prices for the shares on the Singapore Exchange over the five consecutive trading days, immediately preceding the date of grant of that option, as determined by the remuneration committee of CITIC Envirotech by reference to the daily official list or any other publication published by the Singapore Exchange.

-

The Scheme shall continue to be in force at the discretion of the remuneration committee of CITIC Envirotech, subject to a maximum period of 10 years, commencing on February 2010. Subject to compliance with any applicable laws and regulations in Singapore, the Scheme may be continued beyond the above stipulated period with the approval of the shareholders by ordinary resolution at a general meeting and of any relevant authorities which may then be required. The Scheme may be terminated at any time by the remuneration committee or by resolution of the shareholders at a general meeting subject to all other relevant approvals which may be required and if the Scheme is so terminated, no further options shall be offered by CITIC Envirotech hereunder.

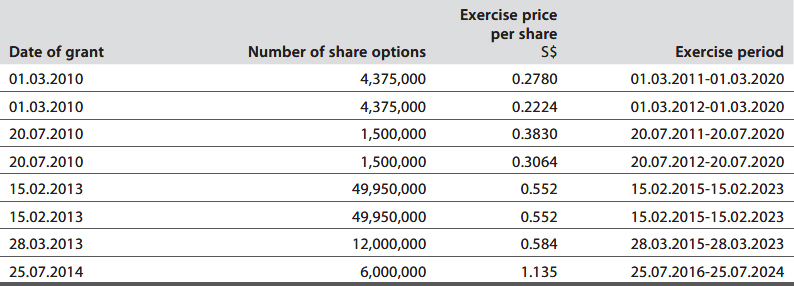

Since the adoption of the Scheme, CITIC Envirotech has granted the following share options:

Under the Scheme, the ordinary shares of CITIC Envirotech under option may be exercised in full or a multiple thereof, on the payment of the exercise price.

The grantees were certain directors and employees of CITIC Envirotech. None were granted to the directors, chief executives or substantial shareholders of the Company. As at 1 January 2017, 53,592,500 ordinary shares of CITIC Envirotech under option were outstanding.

On 1 February 2017, CITIC Envirotech split every one existing ordinary share in its share capital into two shares. During the year ended 31 December 2017, 33,175,800 (post-split) ordinary shares of CITIC Envirotech were exercised, and none of the (post-split) ordinary shares of CITIC Envirotech under option were lapsed or cancelled. As at 31 December 2017, 74,009,200 (post-split) ordinary shares of CITIC Envirotech under option were exercisable.

A summary of the movements of the share options under the Scheme during the year ended 31 December 2017 is as follows:

(a) Directors of CITIC Envirotech

(b) Employees of CITIC Envirotech

No options were granted during the financial year.

Directors’ Interests in Securities

As at 31 December 2017, none of the directors of the Company had nor were they taken or deemed to have, under Part XV of the Securities and Futures Ordinance (“SFO”), any interests or short positions in the shares, underlying shares and debentures of the Company or any of its associated corporations (within the meaning of Part XV of the SFO) as recorded in the register required to be kept by the Company pursuant to section 352 of the SFO or as otherwise notified to the Company and the Hong Kong Stock Exchange pursuant to the Model Code for Securities Transactions by Directors of Listed Companies as set out in the Listing Rules.

Arrangement to Acquire Shares or Debentures

Save for the share option plans as disclosed above, at no time during the year was the Company, its subsidiaries, its fellow subsidiaries or its holding company a party to any arrangements to enable the directors of the Company (including their spouse and children under 18 years of age) to acquire benefits by means of the acquisition of shares or underlying shares in, or debentures of, the Company or any other body corporate.

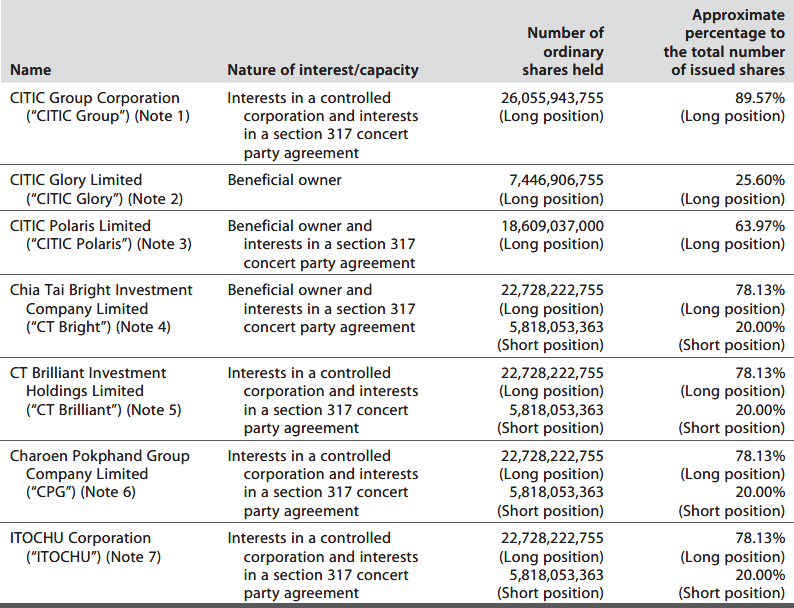

Interests of Substantial Shareholders

As at 31 December 2017, substantial shareholders of the Company (other than directors of the Company) who had interests or short positions in the shares or underlying shares of the Company which would fall to be disclosed to the Company under the provisions of Divisions 2 and 3 of Part XV of the SFO, or which were recorded in the register required to be kept by the Company under section 336 of the SFO, or which were notified to the Company, were as follows:

Notes: (1) CITIC Group is deemed to be interested in 26,055,943,755 shares: (i) by attribution of the interests of its two wholly-owned subsidiaries, CITIC Polaris (9,463,262,637 shares) and CITIC Glory (7,446,906,755 shares); and (ii) because CITIC Group is a party to the Share Purchase Agreement and the Preferred Shares Subscription Agreement which, reading together, constitute an agreement to which section 317(1) of the SFO applies, and accordingly CITIC Group has aggregated its interests in the shares with the interests of the other parties to the Share Purchase Agreement and the Preferred Shares Subscription Agreement. (2) CITIC Glory is beneficially interested in 7,446,906,755 shares of the Company. (3) CITIC Polaris is deemed to be interested in 18,609,037,000 shares: (i) by including 9,463,262,637 shares it holds as beneficial owner; and (ii) because CITIC Polaris is a party to the Share Purchase Agreement which, reading together with the Preferred Shares Subscription Agreement, constitute an agreement to which section 317(1) of the SFO applies, and accordingly CITIC Polaris has aggregated its interests in the shares with the interests of the other parties to the Share Purchase Agreement and the Preferred Shares Subscription Agreement. (4) CT Bright is deemed to be interested in 22,728,222,755 shares: (i) by including 5,818,053,363 shares it holds as beneficial owner; and (ii) because CT Bright is a party to the Share Purchase Agreement and the Preferred Shares Subscription Agreement which, reading together, constitute an agreement to which section 317(1) of the SFO applies, and accordingly CT Bright has aggregated its interests in the shares with the interests of the other parties to the Share Purchase Agreement and the Preferred Shares Subscription Agreement. CT Bright has a short position of 5,818,053,363 shares because it is under an obligation to deliver a maximum of 5,818,053,363 shares to CITIC Polaris if CITIC Polaris’ right of first refusal under the Share Purchase Agreement is exercised in full. (5) CT Brilliant is deemed to be interested in 22,728,222,755 shares and to have a short position of 5,818,053,363 shares as a shareholder of CT Bright directly holding 50% equity interest in CT Bright. (6) CPG is deemed to be interested in 22,728,222,755 shares and to have a short position of 5,818,053,363 shares as a shareholder of CT Bright indirectly holding 50% equity interest in CT Bright through CT Brilliant, its wholly-owned subsidiary. (7) ITOCHU is deemed to be interested in 22,728,222,755 shares and to have a short position of 5,818,053,363 shares as a shareholder of CT Bright directly holding 50% equity interest in CT Bright.

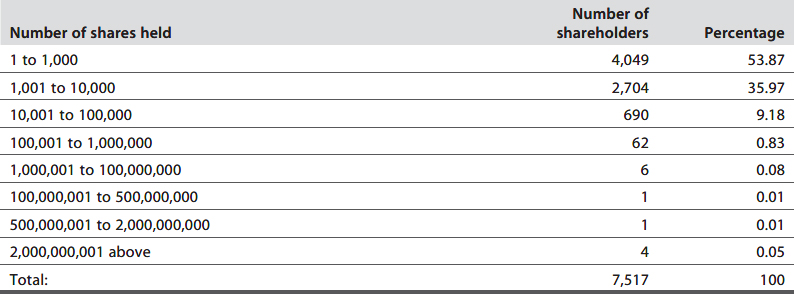

Shareholding Statistics

Based on the share register records of the Company, set out below is a shareholding statistics chart of the registered shareholders of the Company as at 31 December 2017:

As at 31 December 2017, the total number of ordinary shares in issue of the Company was 29,090,262,630 and based on the share register records of the Company, HKSCC Nominees Limited held 9,753,200,310 ordinary shares in entities ranging from 1,000 to 1,000,000,000 ordinary shares and representing 33.53% of the total number of ordinary shares in issue of the Company.

Purchase, Sale or Redemption of Listed Securities

Neither the Company nor any of its subsidiary companies has purchased, sold or redeemed any of the Company’s listed securities during the year ended 31 December 2017.

Disclosure of Information on Directors

The following disclosure is made pursuant to Rule 13.51B(1) of the Listing Rules.

Change in directors’ emoluments

The monthly basic and performance salary of each of Mr Chang Zhenming and Mr Wang Jiong is increased to HK$56,500, and the monthly basic and performance salary of each of Ms Li Qingping and Mr Pu Jian is increased to HK$50,000, all of which took effect from 1 January 2018.

Sufficiency of Public Float

The Hong Kong Stock Exchange has granted a waiver (the “Waiver”) to the Company from strict compliance with the minimum public float of 25% upon completion of the acquisition of CITIC Corporation Limited (the “Acquisition”) on 25 August 2014. Pursuant to the Waiver, the Company has complied with the public float requirement which is at the higher of such a percentage (being 21.87%) of shares held by the public immediately after completion of the Acquisition. Based on the information that is publicly available to the Company and within the knowledge of the directors as at the date of this annual report, the Company has maintained the prescribed public float under the Waiver.

Auditor

The Group’s consolidated financial statements for the year have been audited by Messrs PricewaterhouseCoopers, Certified Public Accountants, who will retire and, being eligible, offer themselves for re-appointment. A resolution for the re-appointment of PricewaterhouseCoopers as auditor of the Company is to be proposed at the 2018 AGM.

By Order of the Board,

Chang Zhenming

Chairman

Hong Kong, 28 March 2018