CITIC-Prudential

CITIC-Prudential is a fifty-fifty joint venture between CITIC Corporation and Prudential Corporation Holdings, offering life, health and accident insurance, and reinsurance services. As of the end of 2017, CITIC-Prudential operated a total of 186 branches in 77 cities across China.

Year in review

In 2017, the accelerating transformation of China’s economy triggered rising demand for pension products and health insurance while the regulation is much tighter over the domestic insurance industry to maintain the protection-oriented trait. Against this complicated situation, to remain up-to-date with the national policies, CITIC-Prudential focused on implementing business structure changes, optimising corporate governance, insisting on major business development, and serving the real economy towards fulfilling customers’ demand. As a result, it has delivered a rapid and healthy growth, while defending the risk bottom line.

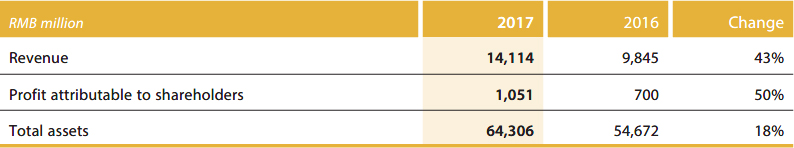

In 2017, CITIC-Prudential recorded operating revenue of RMB14.1 billion, representing a year-on-year increase of 43%, wherein the premium income increased by 46%, higher than the industry average. Net profit increased by 50% to reach RMB1.1 billion, generating an ROE of 24.2%, up 4.5 percentage points over 2016. Total assets also grew 18% to reach RMB64.3 billion.

Risk management

In 2017, CITIC-Prudential continued to implement C-ROSS (China Risk Oriented Solvency System) and built up its comprehensive risk management framework to enhance its risk management capabilities. As of the end of 2017, CITIC-Prudential recorded an aggregated solvency adequacy ratio of 290%, notably above regulatory requirements and the industry average. CITIC-Prudential has further been rated “Class A” by the Chinese Insurance Regulatory Commission (CIRC) in every quarterly Integrated Risk Rating since 2016. It got 85.75, topping the market, in the 2017 Solvency Aligned Risk Management Requirements and Assessment (SARMRA), which was helpful to save the capital and raise the aggregated solvency adequacy ratio.

Products

CITIC-Prudential’s core businesses offer life and health insurance, complemented by asset management and accident insurance services. In 2017, CITIC-Prudential’s premium income for life insurance was RMB8.1 billion, representing a year-on-year increase of 43%, while premium income for health insurance was RMB3.6 billion, representing a year-on-year increase of 58% including a 2 percentage points bump in its contribution to total premium income. By improving protection product over the year while also steadily operating long-term investment insurance business, CITIC-Prudential provided full life-cycle solutions for clients, and built up comprehensive product structure, aiming for the demand of clients. In agency channel, insisting on protection-oriented trait, CITIC-Prudential upgraded its main critical illness products and launched new health and education insurance products, further enriching the balance of its protection product portfolio. In bancassurance, the business in short and medium duration products was scaled down while the contribution from the regular-pay business increased substantially by upgrading main regular-pay product and developing protection product, thus delivering the increase of value stably.

Note:

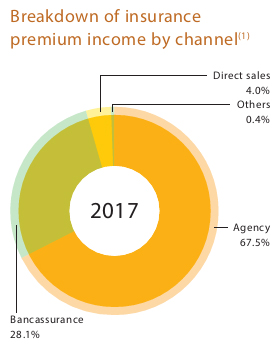

(1) The distribution channel was classified by CIRC base. Group business was mainly in Direct Sales.

Distribution

Agency and bancassurance are CITIC-Prudential’s two primary distribution channels. In 2017, premium income from agency channel was RMB8.1 billion, representing a year-on-year increase of 45% and accounting for 67.5% of the total premium income. The 13-month persistency ratio was at a good level of 94%. CITIC-Prudential also grew its agent force rapidly, ending the year with 44,868 agents, representing an annual increase of 36% in 2017. Independent General Agency teams expanded to 11, which accounted for 10% of total agents and contributed 25% of business in the agency channel, and became the representative of efficient team.

The transformation of the bancassurance channel progressed efficiently over the year, with the segment recording premium income of RMB3.4 billion in 2017, representing a year-on-year increase of 46%. The channel’s product structure was also optimized with contribution from first year regular-pay premium increasing from 39% in 2016 to 45% in 2017. The cooperation with banks was further enhanced to establish more new channels. The business quality has been continuously upgraded with the 13-month persistency ratio of 93%, increasing 7 percentage points.

Investment of insurance funds

In 2017, CITIC-Prudential achieved favourable results in its investment of insurance funds with defending the risk bottom line. Firstly, investment scale grew steadily by 18% to RMB59.6 billion, among which contributions from non-investment-linked account and investment-linked account were RMB49.1 billion and RMB10.4 billion, representing year-on-year increases of 19% and 14% respectively. Secondly, the investment portfolio was optimised successively. Given rising interest rates, more funds were allocated to long-term treasury securities to improve the certainty of future returns while the matching of assets and liabilities were improved. Thirdly, investment returns grew steadily. Investment income from non-investment-linked account also grew by 30% to reach RMB2.3billion. The comprehensive investment yield was 4.97%, representing a year-on-year increase of 1.13 percentage points. Meanwhile, investment categories were enlarged. CITIC-Prudential was approved to make direct investments on real estate during the year. It also improved its operation framework in terms of asset and liability management, asset allocation, risk management, post-investment management and other aspects. The overall investment performance was improved through internal and external channels.

Given the long term and stable supply of insurance funds, CITIC-Prudential invested in infrastructure and public service projects through debt, trust schemes and equity funds over the year. As of the end of 2017, over 20% of its investment assets were allocated to projects related to Belt and Road, urbanisation construction, military and civilian integration, innovations for poverty reduction, rural infrastructure upgrades and other real economy fields, in order to provide strong support to real economy balanced by stringent risk controls.