CITIC Securities

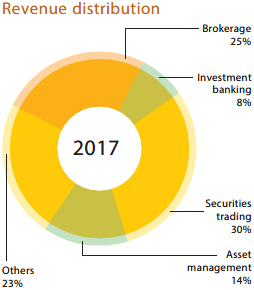

CITIC Securities is the largest securities company in China, with businesses covering investment banking, brokerage services, securities trading and asset management.

Year in review

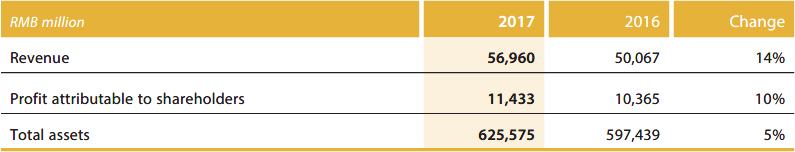

In 2017, CITIC Securities delivered steady performance, contributed in particular by growth in its financing and investment business. Revenue and net profit attributable to shareholders respectively increased by 14% and 10% year-on-year.

Investment banking

CITIC Securities’ equity financing business continued to perform well in 2017, cementing the firm’s leadership in the A-share market. As the lead underwriter on transactions with an aggregate value of RMB221 billion, the business closed the year with a market share of 12%.

The company’s debt and structured financing business, also the market leader in China, completed 726 projects with an aggregate value of RMB511.6 billion, in lead underwriting bonds, medium term notes, commercial papers and asset-backed securities, for which it achieved an industry-topping market share of 4%.

Over the year, CITIC Securities further completed material assets restructuring of A-share companies with an aggregate value of RMB139.8 billion, also a no. 1 within the industry. In mergers and acquisitions, CITIC Securities was second among Chinese securities firms for M&A transactions involving Chinese companies.

CITIC Securities acted as lead sponsor for a total of 59 enterprises seeking to list on China’s over-the-counter market, the National Equities Exchange and Quotation exchange. The company ranked at the top in industry evaluations of quality services provided by lead sponsors.

Brokerage services

In 2017, the company’s brokerage business maintained its industry-leading position, ranking second for each of total equities and funds trading volume and net income from brokerage fees. The total number of brokerage clients for the year exceeded 7.7 million, up 15% over 2016, for total assets of RMB5 trillion, representing an 18% year-on-year rise.

Asset management

The asset management business covers both corporate and retail markets, with particular focus on the corporate sector. In 2017, CITIC Securities continued to grow its business and expand its customer base by delivering strong research and investment services with a wide of range of product offerings. At the end of the year, total AUM reached RMB1.7 trillion, representing a market share of 10% — the industry’s largest.

CITIC Securities is the largest shareholder of China AMC, a leading asset management company with RMB869.6 billion under management as at the end of 2017, of which RMB398.8 billion is contributed by public funds and RMB470.8 billion from institutional assets (excluding investment consulting and other businesses).

Trading

CITIC Securities’ trading business comprises both flow-based business and proprietary trading.

In its flow-based business, CITIC Securities offers financial services including equity flow-based, fixed income and commodities trading, as well as prime services consulting. The balance of margin financing and securities lending reached RMB71 billion, representing a market share of 7% — the industry’s largest in this segment.

The company further delivers both proprietary trading and alternative investment services. To balance ambitious growth with strict risk management, the company considers the risk-to-revenue ratio as an important criteria in all investment decisions.

International business

In 2017, CITIC Securities completed the restructuring of its overseas business under the single brand of CLSA. The company’s new integrated off-shore financial platform will offer institutional and other clients direct access to international capital markets.